Debt can feel like a mountain you’ll never climb. No matter how hard you try, the balances barely seem to budge and it’s hard to stay motivated. If this sounds familiar, you’re not alone. Many people face the same struggle, but the good news is that there are strategies that can help you tackle debt systematically and confidently. Two of the most popular methods are the Debt snowball and the Debt avalanche.

So, how do these strategies work and which one is best for you? Let’s break them down, side by side, so you can decide which method fits your financial situation and personality.

What is the Debt snowball method?

The debt snowball method is all about momentum. With this strategy, you focus on paying off your debts from the smallest to the largest balance, regardless of their interest rates.

Here’s how it works:

- List all your debts in order of balance, from smallest to largest.

- Make the minimum payment on all debts, except for the smallest one.

- Put as much extra money as you can toward the smallest debt until it’s paid off.

- Once the smallest debt is gone, roll that payment into the next smallest debt and so on.

Why it works

The psychology behind the debt snowball is powerful. Knocking out smaller debts quickly gives you a series of “wins” early on, which builds confidence and keeps you motivated.

Example of the Debt snowball

Imagine you have the following debts:

- Credit card #1: $500 balance, 15% interest

- Credit card #2: $2,000 balance, 18% interest

- Personal loan: $5,000 balance, 10% interest

With the debt snowball, you’d start by paying off Credit Card #1 first, even though its interest rate isn’t the highest. Once that’s paid off, you’d roll the payment into Credit Card #2, and then tackle the personal loan last.

Pros of the Debt snowball

- Quick psychological wins keep you motivated.

- Easy to stick with because it feels rewarding early on.

Cons of the Debt snowball

- You may end up paying more in interest over time if your largest debts have high interest rates.

What is the Debt avalanche method?

The debt avalanche method focuses on saving money by tackling your highest-interest debts first.

Here’s how it works:

- List all your debts in order of interest rate, from highest to lowest.

- Make the minimum payment on all debts, except the one with the highest interest rate.

- Put any extra money toward the highest-interest debt until it’s paid off.

- Move on to the next highest-interest debt, and repeat.

Why it works

The debt avalanche saves you the most money in the long run by minimizing how much you pay in interest. This method is all about the numbers.

Example of the Debt avalanche

Using the same debts as above:

- Credit card #1: $500 balance, 15% interest

- Credit card #2: $2,000 balance, 18% interest

- Personal loan: $5,000 balance, 10% interest

With the debt avalanche, you’d pay off Credit Card #2 first because it has the highest interest rate. Then, you’d move to Credit Card #1, and finally to the personal loan.

Pros of the Debt avalanche

- Saves money on interest, especially if you have high-interest debts.

- Can help you pay off debts faster overall.

Cons of the Debt avalanche

- Progress can feel slower, especially if your highest-interest debt has a large balance.

- It can be harder to stay motivated without early wins.

Debt snowball vs. Debt avalanche: A Side-by-Side comparison

| Criteria | Debt snowball | Debt avalanche |

|---|---|---|

| Focus | Smallest balance first | Highest interest rate first |

| Motivation | Provides quick wins | May feel slower initially |

| Interest savings | Typically costs more in interest | Saves the most on interest |

| Best for | People who need motivation to stay consistent | People who prioritize saving money |

If you’re someone who thrives on small victories, the debt snowball might be your best bet. But if you’re laser-focused on saving money and getting out of debt faster, the debt avalanche will likely work better for you.

How to decide which Debt Payoff strategy is right for you

Choosing between the debt snowball and debt avalanche depends on your personality, financial goals and current situation.

Ask yourself:

- Do I need quick wins to stay motivated?

- If yes, go with the debt snowball.

- Is saving the most money in interest my top priority?

- If yes, choose the debt avalanche.

- How large are my high-interest debts?

- If the balance is overwhelming, the debt snowball might help build momentum.

Tip: Combine strategies

Some people start with the debt snowball to build confidence, then switch to the debt avalanche to save on interest. The best strategy is the one that keeps you motivated and making progress.

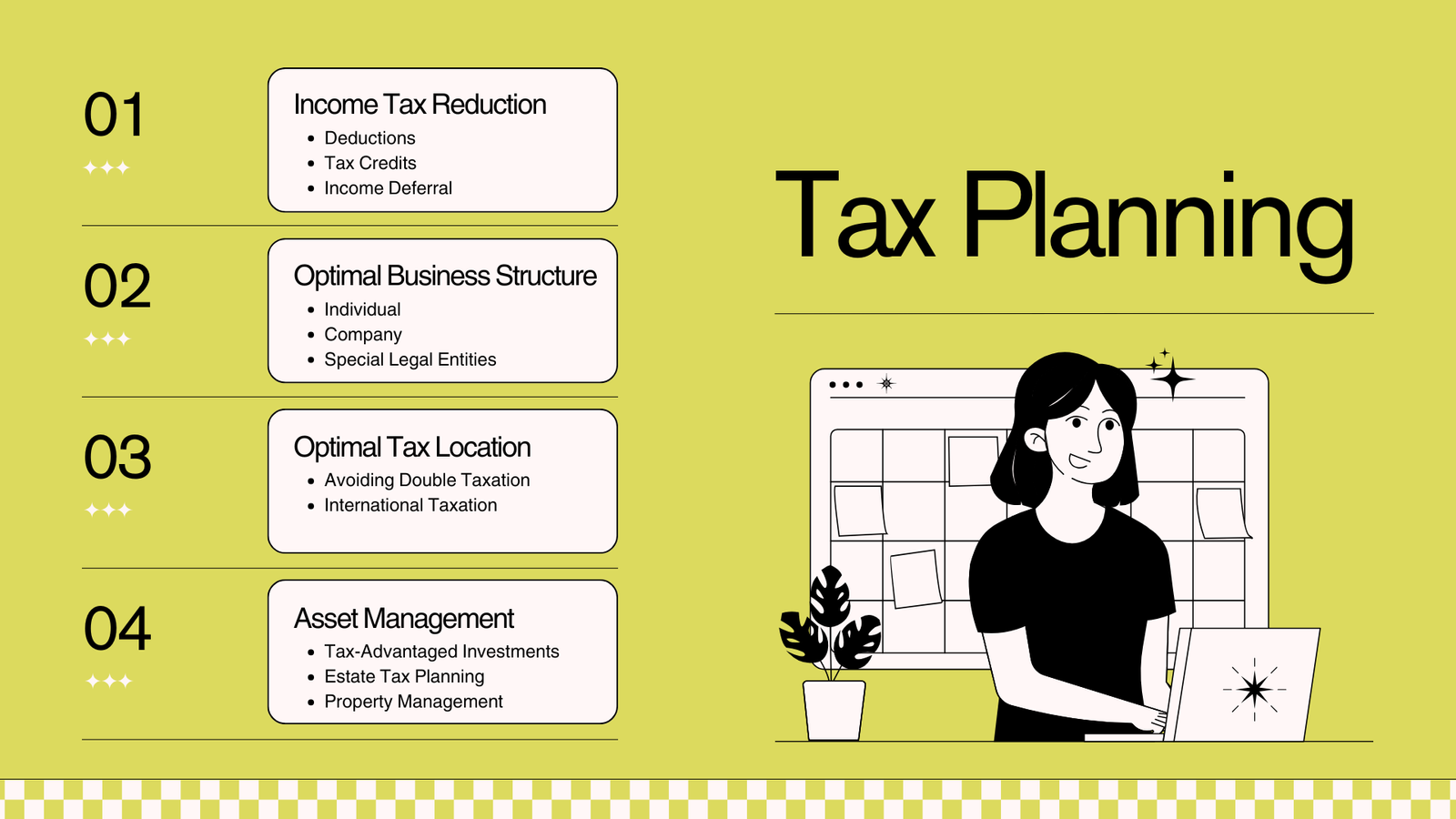

Tools and resources to get started

To make the process easier, consider using tools like:

- YNAB (You Need A Budget): Helps you track your debt payoff progress.

- Debt calculators: Visualize how much you’ll save with each method.

- Spreadsheets or apps: Organize your debts and repayment plan.

For more information about budgeting visit our website.

Conclusion

Both the debt snowball and debt avalanche methods are effective ways to eliminate debt—you just have to choose the one that aligns with your goals and mindset. Whether you thrive on quick wins or want to save as much as possible, the key is sticking to your plan. Remember, the real victory isn’t in the method you choose, it’s in becoming debt-free and taking back control of your finances.

So, which will you try first: the debt snowball or the debt avalanche? Start today and watch your debt shrink as your confidence grows.

Please subscribe Easy Budget to stay updated about our latest blogs!