Did you know that 78% of Americans live paycheck to paycheck? If you’re struggling to save money or feel overwhelmed by budgeting, you’re not alone. But what if there was a simple way to take control of your finances without needing a degree in accounting?

Enter the 50 30 20 rule—a straightforward budgeting method that divides your income into three categories: needs, wants and savings. And the best part? You don’t need to be a math whiz to use it. With a 50 30 20 rule calculator, you can create a budget that works for you in just minutes.

In this guide, I’ll walk you through everything you need to know about the 50 30 20 rule, how to use a calculator to apply it and why it’s one of the easiest ways to manage your money in 2025. Let’s get started!

What is the 50 30 20 rule?

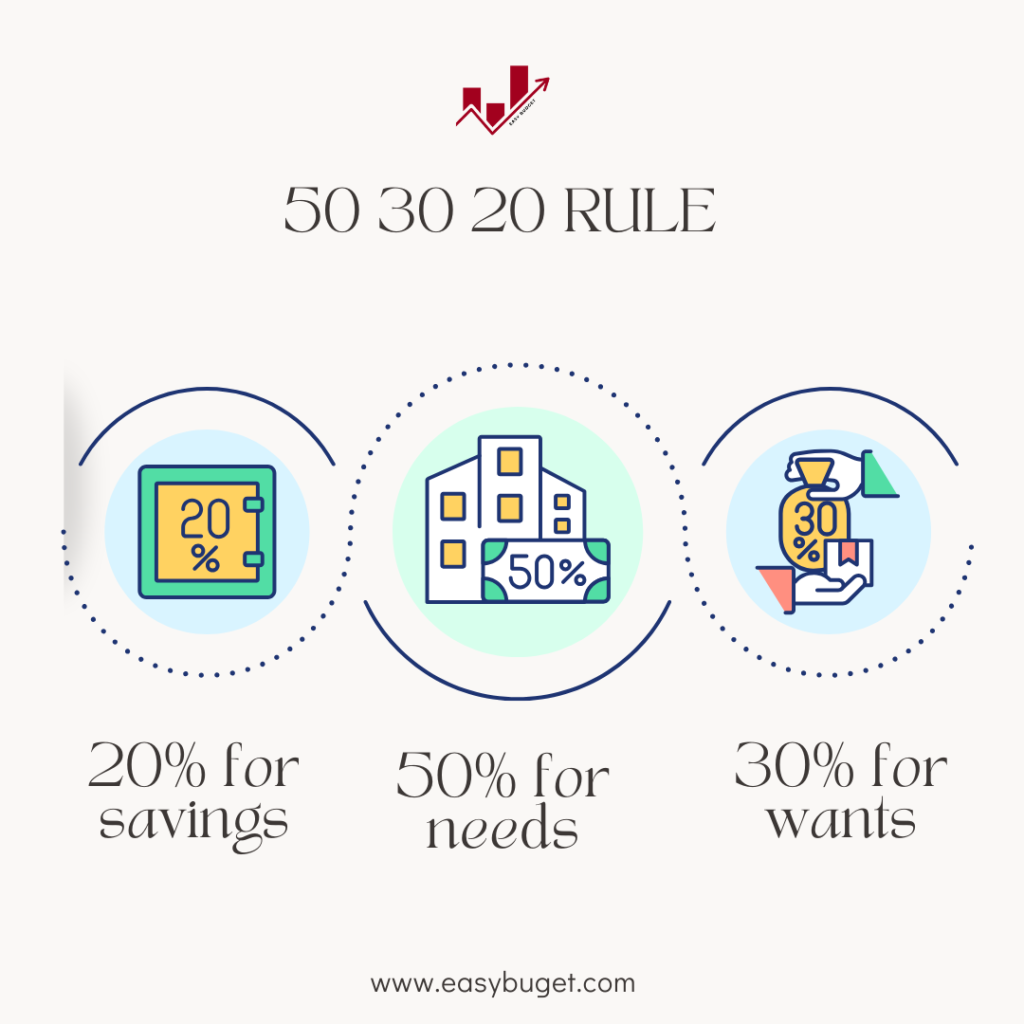

The 50 30 20 rule is a simple budgeting framework that helps you allocate your income into three categories:

- 50% for Needs: Essential expenses like rent, utilities, groceries and insurance.

- 30% for Wants: Non-essential spending like dining out, entertainment and hobbies.

- 20% for savings and debt repayment: Building an emergency fund, saving for retirement, or paying off debt.

This rule is designed to be flexible and easy to follow, making it perfect for beginners or anyone looking to simplify their finances.

Why the 50 30 20 rule works

The 50 30 20 rule is more than just a budgeting method—it’s a mindset shift. Here’s why it works:

- Simplicity: Unlike complicated budgeting systems, the 50 30 20 rule is easy to understand and apply.

- Flexibility: It adapts to your income and lifestyle, whether you earn 2,000 or 10,000 a month.

- Balance: It ensures you’re covering your essentials, enjoying life and saving for the future—all at the same time.

In 2025, with rising living costs and economic uncertainty, having a balanced budget is more important than ever.

How to use a 50 30 20 rule calculator

Using a 50 30 20 rule calculator is the easiest way to apply this budgeting method. Here’s how it works:

- Enter your monthly income: Start with your take-home pay (after taxes).

- Allocate 50% to needs: The calculator will show how much to spend on essentials like rent, utilities and groceries.

- Allocate 30% to wants: This covers discretionary spending like dining out, entertainment, and subscriptions.

- Allocate 20% to Savings and Debt: The calculator will suggest how much to save or put toward debt repayment.

For example, if your monthly income is $3,000:

- Needs: $1,500

- Wants: $900

- Savings/Debt: $600

Use our free 50 20 30 rule calculator!

Step-by-Step guide to apply the 50 30 20 rule

Ready to put the 50 30 20 rule into action? Follow these steps:

1. Calculate your monthly income

Start with your take-home pay. If your income varies, use an average or your lowest monthly income to stay safe.

2. Categorize your expenses

- Needs (50%): Rent/mortgage, utilities, groceries, transportation, insurance.

- Wants (30%): Dining out, entertainment, hobbies, subscriptions.

- Savings/Debt (20%): Emergency fund, retirement savings, credit card payments, student loans.

3. Adjust based on your situation

If your needs exceed 50%, reduce your wants or find ways to cut costs (e.g., meal planning, canceling unused subscriptions).

4. Track your spending

Use budgeting apps like Mint, YNAB (You Need a Budget), or PocketGuard to monitor your spending and stay on track.

Tips for Sticking on the 50 30 20 budget rule

- Automate savings: Set up automatic transfers to your savings account each payday.

- Review regularly: Check your budget monthly to ensure you’re staying on track.

- Be realistic: If 30% for wants feels too high, adjust it to fit your lifestyle.

- Celebrate small wins: Reward yourself when you hit savings goals or pay off debt.

Common mistakes to avoid

- Overestimating your income: Always base your budget on your take-home pay, not your gross income.

- Misclassifying wants as needs: Be honest about what’s essential and what’s not.

- Neglecting irregular expenses: Plan for annual or quarterly expenses (e.g., car insurance) by setting aside money each month.

FAQs About the 50 30 20 rule

1. Can I adjust the 50/30/20 rule to fit my income?

Absolutely! If your needs exceed 50%, adjust the percentages to fit your situation (e.g., 60/20/20).

2. What counts as a ‘need’ vs a ‘want’?

Needs are essential expenses (e.g., rent, groceries), while wants are discretionary (e.g., dining out, Netflix).

3. How do I handle irregular income with the 50 30 20 rule?

Use your lowest monthly income as a baseline, or average your income over several months.

4. Is the 50 30 20 rule good for saving for big goals?

Yes! Allocate part of your 20% savings to specific goals like a down payment or vacation.

Conclusion

The 50 30 20 rule is one of the simplest and most effective ways to take control of your finances. By dividing your income into needs, wants, and savings, you can create a balanced budget that works for your lifestyle—even in 2025’s unpredictable economy.

Ready to get started? Use a 50 30 20 rule calculator to create your budget today and take the first step toward financial freedom.

Call-to-Action:

- Have you tried the 50 30 20 rule? Share your experience in the comments below!

- Found this guide helpful? Share it with your friends and family to help them take control of their finances too!

- Use our free 50 30 20 rule calculator to calculate and make your budget.

Please subscribe Easy Budget to stay updated about our latest blogs!

2 thoughts on “The 50 30 20 rule: How to use a calculator to manage your money in 2025”