Managing your finances doesn’t have to be a headache. With budgeting apps like Quicken Simplifi, you can take control of your money with ease. But with so many options available, is Quicken Simplifi the best choice for you in 2025? In this comprehensive review, we’ll dive deep into its features, pricing, pros, cons, and how it stacks up against the competition. By the end, you’ll know whether Quicken Simplifi deserves a spot on your phone—and whether it can help you achieve your financial goals.

What is Quicken Simplifi?

Quicken Simplifi is a modern, cloud-based budgeting app designed to simplify personal finance management. It’s part of the Quicken family, a trusted name in financial software for decades. Unlike traditional Quicken products, Simplifi is built for simplicity and ease of use, making it perfect for individuals and families who want a straightforward way to track their money.

The app focuses on three core areas:

- Spending Tracking: Automatically categorizes and tracks your expenses.

- Savings Goals: Helps you set and achieve financial goals.

- Financial Insights: Provides actionable insights to improve your financial health.

Key Features of Quicken Simplifi

Quicken Simplifi is packed with features that make budgeting effortless. Here’s a closer look at what it offers:

1. Spending Plan

- Simplifi creates a personalized spending plan based on your income and expenses. It shows how much you can safely spend each month while staying on track with your goals.

2. Custom Savings Goals

- Whether you’re saving for a vacation, a new car, or an emergency fund, Simplifi lets you set and track custom goals. It even shows your progress in real-time.

3. Subscription Tracking

- Simplifi identifies recurring subscriptions and bills, helping you avoid unnecessary expenses. It’s a great way to stay on top of your monthly commitments.

4. Bill Reminders

- Never miss a payment again. Simplifi sends reminders for upcoming bills, so you can avoid late fees and stay organized.

5. Reports and Insights

- Simplifi provides detailed reports on your spending habits, net worth, and cash flow. These insights help you make smarter financial decisions.

6. Mobile and Web Access

- Simplifi is available on both mobile (iOS and Android) and web, so you can manage your finances anytime, anywhere.

7. New for 2025: Enhanced Investment Tracking

- Simplifi has introduced improved investment tracking features, allowing users to monitor their portfolios alongside their budgets.

8. AI-Powered Insights

- Leveraging AI, Simplifi now offers personalized financial advice and predictive insights to help users make better financial decisions.

Pros of Quicken Simplifi

Here’s why Quicken Simplifi stands out from the crowd:

- User-Friendly Interface: The app is clean, intuitive, and easy to navigate, even for beginners.

- Comprehensive Financial Overview: Simplifi gives you a complete picture of your finances in one place.

- Customizable Budgeting Tools: Create personalized budgets that fit your lifestyle.

- Excellent Customer Support: Quicken offers reliable support through chat, email, and phone.

- No Ads: Unlike free apps like Mint, Simplifi is ad-free, providing a seamless user experience.

- AI-Powered Insights: The new AI features provide personalized financial advice and predictive insights.

Cons of Quicken Simplifi

While Quicken Simplifi is a strong contender, it’s not without its drawbacks:

- Limited Investment Tracking: Despite improvements, Simplifi still focuses primarily on budgeting and doesn’t offer robust investment tracking like some competitors.

- No Free Plan: Simplifi requires a subscription, which might not appeal to users looking for a free option.

- Occasional Syncing Issues: Some users report minor syncing problems with certain banks.

- No Bill Pay Feature: Unlike Quicken’s desktop software, Simplifi doesn’t allow you to pay bills directly through the app.

How Quicken Simplifi Compares to Other Budgeting Apps

How does Quicken Simplifi stack up against other popular budgeting apps? Here’s a quick comparison:

| Feature | Quicken Simplifi | Mint | YNAB | Personal Capital |

|---|---|---|---|---|

| Pricing | $3.99/month | Free | $14.99/month | Free (with premium options) |

| Spending Tracking | Yes | Yes | Yes | Yes |

| Savings Goals | Yes | Yes | Yes | No |

| Investment Tracking | Limited | Yes | No | Yes |

| User Interface | Clean & Simple | Cluttered | Steep Learning Curve | Advanced |

| Ad-Free | Yes | No | Yes | No |

| AI-Powered Insights | Yes | No | No | No |

Quicken Simplifi strikes a balance between affordability and functionality, making it a strong competitor in the budgeting app space.

Who is Quicken Simplifi Best For?

Quicken Simplifi is ideal for:

- Individuals who want a simple yet powerful budgeting tool.

- Families looking to track shared expenses and savings goals.

- Beginners who prefer an easy-to-use interface without overwhelming features.

- Anyone who values ad-free, clutter-free financial tracking.

If you’re someone who values simplicity and comprehensive financial tracking, Quicken Simplifi might be the perfect fit for you.

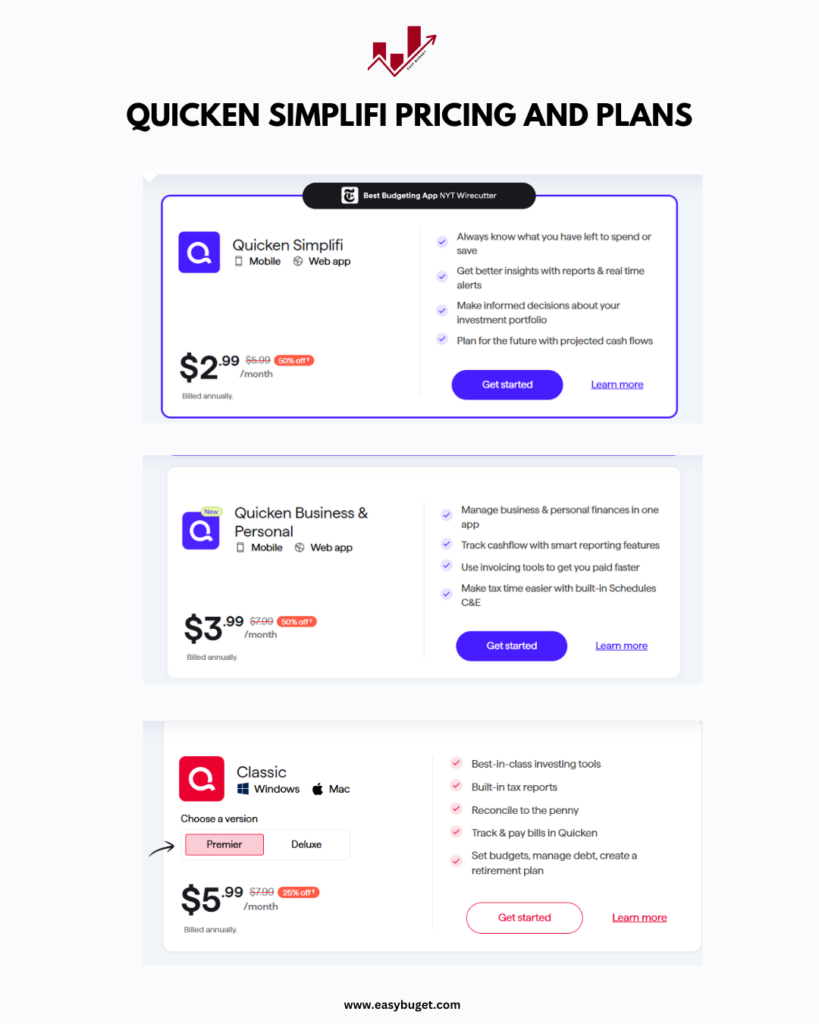

Pricing and Plans

While it doesn’t offer a free plan, it does provide a 30-day free trial so you can test it out before committing. Compared to other budgeting apps, Simplifi’s pricing is competitive, especially considering its robust features and ad-free experience.

User Experience and Interface

One of Quicken Simplifi’s biggest strengths is its user-friendly design. The app’s interface is clean, modern, and easy to navigate. Setting up your account is straightforward, and the dashboard provides a clear overview of your finances. Whether you’re checking your spending trends or setting a savings goal, everything is just a few clicks away.

The mobile app is equally impressive, with a sleek design and seamless syncing between devices. You can access your financial data anytime, anywhere, making it a great choice for on-the-go users.

Security and Privacy

When it comes to your financial data, security is non-negotiable. Quicken Simplifi uses bank-level encryption to protect your information. Additionally, it doesn’t store your banking credentials, so you can rest assured that your data is safe. The app also offers multi-factor authentication (MFA) for added security.

Final Verdict: Is Quicken Simplifi Worth It?

Quicken Simplifi is a powerful budgeting app that combines simplicity with robust features. While it may not be perfect—its lack of investment tracking and occasional syncing issues are worth noting—it’s an excellent choice for anyone looking to take control of their finances. If you’re willing to pay for a subscription and want a tool that’s both easy to use and highly effective, Quicken Simplifi is definitely worth considering.

FAQs About Quicken Simplifi

1. Is Quicken Simplifi free?

No, Quicken Simplifi requires a subscription. It costs 3.99/month, but it offers a 30-day free trial.

2. Can I use Quicken Simplifi offline?

No, Quicken Simplifi is a cloud-based app and requires an internet connection to sync your financial data.

3. How does Quicken Simplifi compare to Mint?

Quicken Simplifi offers a more streamlined and user-friendly experience compared to Mint, but Mint is free while Simplifi requires a subscription.

4. Does Quicken Simplifi support investment tracking?

Simplifi offers limited investment tracking. If you need advanced investment features, consider apps like Personal Capital.

5. Is Quicken Simplifi safe to use?

Yes, Quicken Simplifi uses bank-level encryption and multi-factor authentication to protect your data.

Ready to Simplify Your Budgeting?

If you’re looking for a budgeting app that’s both powerful and easy to use, Quicken Simplifi is a top contender. Give it a try with their 30-day free trial and see if it’s the right fit for your financial goals. For more budgeting tips and app reviews, stay tuned to easybuget.com!