Did you know that 78% of Americans live paycheck to paycheck? If you’re tired of feeling like your money controls you instead of the other way around, it’s time to dive into Budgeting 101. Budgeting isn’t just about cutting back—it’s about taking control of your finances, reducing stress, and achieving your goals. Whether you’re saving for a dream vacation, paying off debt, or just trying to make ends meet, this beginner’s guide will walk you through everything you need to know about Budgeting 101.

What is Budgeting and Why Do You Need One?

At its core, budgeting is simply a plan for how you’ll spend and save your money each month. It’s like a roadmap for your finances, helping you track your income, control your spending, and work toward your financial goals. Without a budget, it’s easy to overspend, fall into debt, or miss out on opportunities to save and invest.

Think of it this way: Would you start a road trip without a map or GPS? Probably not. A budget is your financial GPS, guiding you toward your destination—whether that’s buying a home, retiring early, or just having peace of mind.

For a deeper dive into the definition of budgeting, check out Investopedia’s guide.

Why Budgeting is a Game-Changer for Your Finances

Budgeting isn’t just about restricting yourself—it’s about empowering yourself. Here are some of the key benefits of budgeting:

- Control Over Spending: Know exactly where your money is going and avoid overspending.

- Debt Reduction: Allocate funds to pay off debt faster and save on interest.

- Savings Growth: Set aside money for emergencies, big purchases, and long-term goals.

- Financial Peace of Mind: Reduce stress by having a clear plan for your money.

According to NerdWallet, budgeting can help you build better financial habits and achieve your goals faster.

Budgeting 101: Step-by-Step Guide to Creating Your First Budget

Ready to create your first budget? Follow these simple steps:

1. Calculate Your Income

Start by adding up all your sources of income, including your salary, side hustles, and any other earnings. This is the foundation of your budget.

2. List Your Expenses

Next, list all your expenses. Break them into two categories:

- Fixed Expenses: Rent, utilities, car payments, and other regular bills.

- Variable Expenses: Groceries, entertainment, dining out, and other discretionary spending.

3. Set Financial Goals

What are you saving for? Whether it’s an emergency fund, a vacation, or retirement, define your short-term and long-term goals.

4. Allocate Your Money

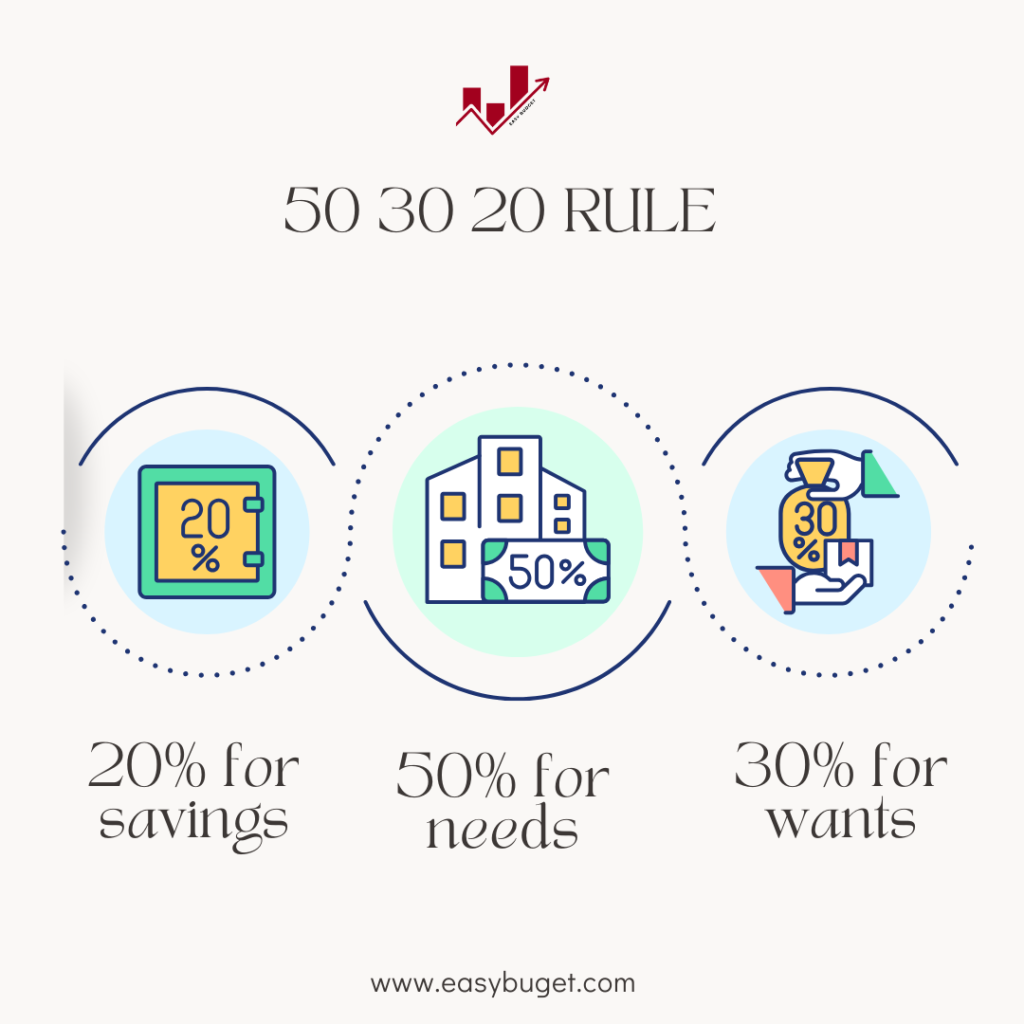

Use the 50/30/20 rule as a starting point:

- 50% for Needs: Essential expenses like housing, utilities, and groceries.

- 30% for Wants: Non-essential spending like dining out and entertainment.

- 20% for Savings/Debt Repayment: Build your savings or pay off debt.

5. Track and Adjust

Review your budget monthly to see how you’re doing. Make adjustments as needed to stay on track.

For more tips on creating a budget, check out Mint’s budgeting guide.

Choosing the Right Budgeting Method for You

Not all budgets are created equal. Here are some popular budgeting methods to consider:

1. The 50/30/20 Rule

This simple method divides your income into three categories: needs, wants, and savings/debt repayment.

2. The Envelope System

Allocate cash into envelopes for different spending categories. Once the cash is gone, you’re done spending in that category.

3. Zero-Based Budgeting

Assign every dollar a job, so your income minus expenses equals zero. This method ensures you’re intentional with every dollar.

4. Pay Yourself First

Prioritize savings by setting aside money for your goals before paying bills or spending on wants.

For a detailed comparison of budgeting methods, visit The Balance’s guide.

Tools to Help You Budget

Budgeting doesn’t have to be complicated. Here are some tools to make it easier:

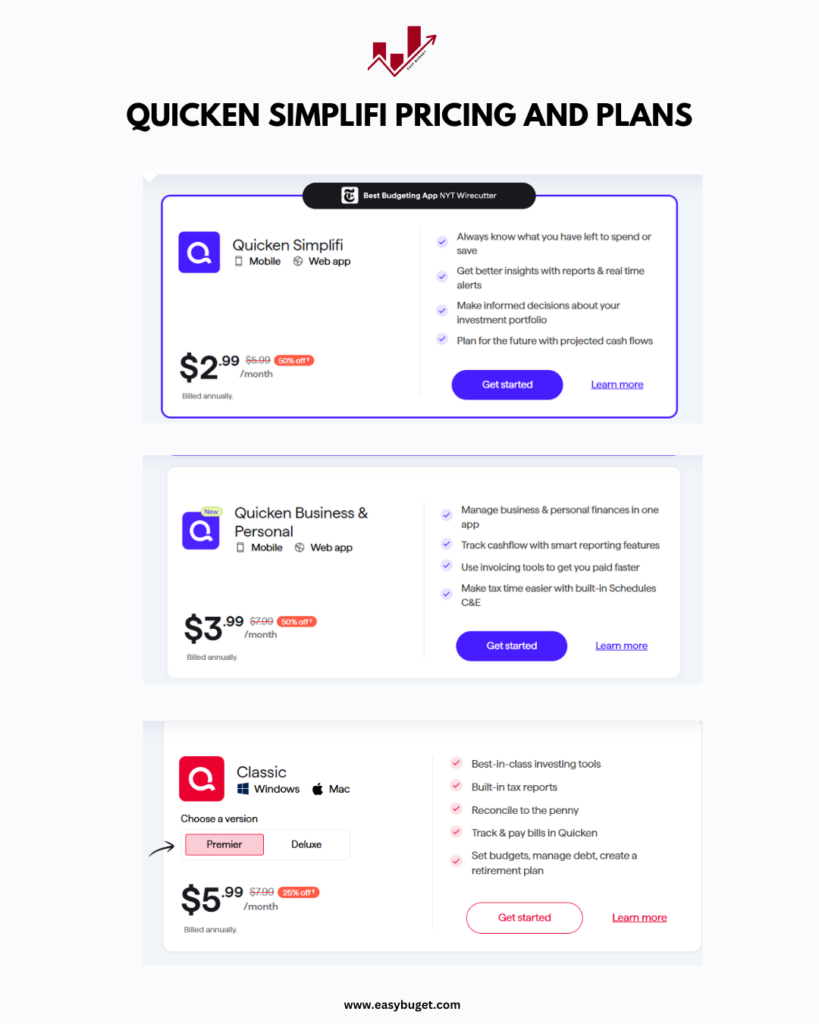

- Budgeting Apps: Apps like Mint, YNAB (You Need A Budget), and PocketGuard can automate tracking and provide insights.

- Spreadsheets: Use Excel or Google Sheets for a customizable budgeting experience.

- Pen and Paper: Sometimes, the simplest method is the most effective.

For a comparison of budgeting tools, check out Goodbudget’s guide.

Common Budgeting Mistakes to Avoid

Even with the best intentions, it’s easy to make mistakes. Here are some common pitfalls to watch out for:

- Not Tracking Expenses: You can’t stick to a budget if you don’t know where your money is going.

- Setting Unrealistic Goals: Start small and gradually increase your savings targets.

- Ignoring Irregular Expenses: Plan for annual or seasonal expenses like holidays or car maintenance.

- Giving Up Too Soon: Budgeting takes practice—stick with it!

For more on budgeting mistakes, read CNBC’s article.

How to Stay on Track and Achieve Your Goals

Sticking to a budget can be challenging, but these tips can help:

- Automate Savings: Set up automatic transfers to your savings account.

- Use Cash for Discretionary Spending: Limit overspending by using cash for wants.

- Review Regularly: Check your budget weekly or monthly to stay on track.

- Celebrate Small Wins: Reward yourself for reaching milestones.

For more tips on sticking to a budget, visit Forbes’ guide.

Budgeting 101: Your First Step Toward Financial Freedom

Budgeting is more than just a financial tool—it’s a lifestyle change. By taking control of your money, you can reduce stress, achieve your goals, and build a brighter financial future. Remember, budgeting isn’t about perfection; it’s about progress. Start small, stay consistent, and watch your financial life transform.

Frequently Asked Questions About Budgeting

What is budgeting?

Budgeting is a plan for how you’ll spend and save your money each month.

Why is budgeting important?

It helps you control your spending, save money, and achieve financial goals.

What’s the best budgeting method?

It depends on your needs, but the 50/30/20 rule is a great starting point.

How do I stick to a budget?

Track your spending, set realistic goals, and review your budget regularly.

What tools can help me budget?

Apps like Mint and YNAB, or simple spreadsheets, can make budgeting easier.

By following this guide, you’ll not only understand Budgeting 101 but also have the tools and confidence to take control of your finances. Start today—your future self will thank you!