Managing your money can feel like a never-ending battle, but budgeting apps like YNAB (You Need A Budget) promise to make it easier. With its unique approach to budgeting, YNAB has gained a loyal following over the years. But is it really worth the hype in 2025? In this in-depth YNAB Review, we’ll break down everything you need to know about YNAB—its features, pricing, pros, cons, and how it stacks up against the competition. By the end, you’ll know whether YNAB is the right tool to help you take control of your finances.

What is YNAB?

YNAB, short for You Need A Budget, is a budgeting app designed to help you take a proactive approach to managing your money. Unlike traditional budgeting tools that focus on tracking past spending, YNAB encourages you to plan ahead by giving every dollar a job. It’s built on four core principles:

- Give Every Dollar a Job: Assign a purpose to every dollar you earn.

- Embrace Your True Expenses: Plan for irregular expenses like car repairs or holidays.

- Roll with the Punches: Adjust your budget as life happens.

- Age Your Money: Build a buffer so you’re spending money you earned at least 30 days ago.

YNAB isn’t just an app—it’s a philosophy. And in 2025, it continues to stand out as one of the most unique budgeting tools on the market.

Key Features of YNAB

YNAB is packed with features that make budgeting both effective and intuitive. Here’s a closer look at what it offers:

1. Zero-Based Budgeting

- YNAB uses a zero-based budgeting system, which means every dollar you earn is assigned a specific purpose. This approach helps you stay intentional about your spending and saving.

2. Real-Time Syncing

- YNAB syncs with your bank accounts and credit cards to provide real-time updates on your transactions. No more manual entry!

3. Goal Tracking

- Whether you’re saving for a vacation, paying off debt, or building an emergency fund, YNAB lets you set and track custom goals.

4. Reports and Insights

- YNAB provides detailed reports on your spending habits, net worth, and progress toward your goals. These insights help you make smarter financial decisions.

5. Mobile and Web Access

- YNAB is available on both mobile (iOS and Android) and web, so you can manage your budget anytime, anywhere.

6. Educational Resources

- YNAB offers free workshops, tutorials, and a supportive community to help you master the app and improve your financial literacy.

7. New for 2025: Enhanced Mobile Experience

- YNAB has introduced a more intuitive mobile interface, making it easier than ever to manage your budget on the go.

Pros of YNAB

Here’s why YNAB stands out from the crowd:

- Proactive Budgeting: YNAB encourages you to plan ahead, which can help you avoid overspending and build better financial habits.

- Excellent Educational Resources: The free workshops and tutorials are a game-changer for beginners.

- Strong Community Support: YNAB’s forums and user groups are incredibly active and supportive.

- No Ads: Unlike free apps like Mint, YNAB is ad-free, providing a seamless user experience.

- Real-Time Syncing: Automatic syncing with your bank accounts saves time and ensures accuracy.

Cons of YNAB

While YNAB is a powerful tool, it’s not without its drawbacks:

- Steep Learning Curve: YNAB’s unique approach can take time to master, especially for beginners.

- No Free Plan: YNAB requires a subscription, which might not appeal to users looking for a free option.

- Limited Investment Tracking: YNAB focuses primarily on budgeting and doesn’t offer robust investment tracking like some competitors.

- Pricing: At 14.99/month or 99/year, YNAB is one of the more expensive budgeting apps on the market.

How YNAB Compares to Other Budgeting Apps (Tabular YNAB Review)

How does YNAB stack up against other popular budgeting apps? Here’s a quick comparison:

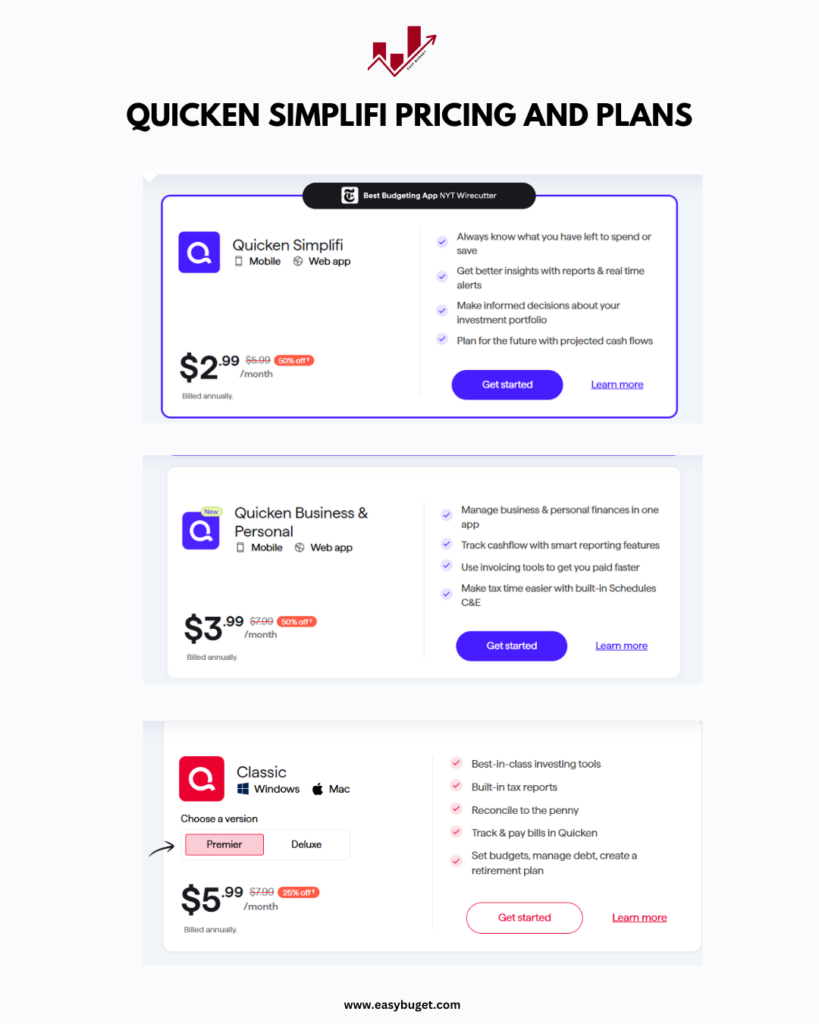

| Feature | YNAB | Mint | Quicken Simplifi | Personal Capital |

|---|---|---|---|---|

| Pricing | $14.99/month | Free | $3.99/month | Free (with premium options) |

| Budgeting Method | Zero-Based | Tracking | Spending Plan | Tracking |

| Goal Tracking | Yes | Yes | Yes | No |

| Investment Tracking | Limited | Yes | Limited | Yes |

| User Interface | Steep Learning Curve | Cluttered | Clean & Simple | Advanced |

| Ad-Free | Yes | No | Yes | No |

YNAB’s zero-based budgeting approach sets it apart, but its higher price and learning curve may not appeal to everyone.

Who is YNAB Best For?

YNAB is ideal for:

- Individuals who want a proactive approach to budgeting.

- Families looking to manage shared expenses and savings goals.

- Beginners willing to invest time in learning the system.

- Anyone who values ad-free, clutter-free financial tracking.

If you’re someone who wants to take control of your finances and build better money habits, YNAB might be the perfect fit for you.

Pricing and Plans

YNAB costs 14.99 per month or 99 per year. While it doesn’t offer a free plan, it does provide a 34-day free trial so you can test it out before committing. Compared to other budgeting apps, YNAB is on the pricier side, but many users find its unique approach worth the investment.

User Experience and Interface

YNAB’s interface is clean and modern, but it does come with a learning curve. The app’s zero-based budgeting method requires a shift in mindset, and it can take a few weeks to fully grasp the system. However, once you get the hang of it, YNAB becomes an incredibly powerful tool for managing your money.

The mobile app is sleek and easy to use, with seamless syncing between devices. You can access your budget anytime, anywhere, making it a great choice for on-the-go users.

Security and Privacy

When it comes to your financial data, security is non-negotiable. YNAB uses bank-level encryption to protect your information. Additionally, it doesn’t store your banking credentials, so you can rest assured that your data is safe. The app also offers multi-factor authentication (MFA) for added security.

Final Verdict: Is YNAB Worth It?

YNAB is a powerful budgeting app that offers a unique, proactive approach to managing your finances. While it may not be perfect—its steep learning curve and higher price are worth noting—it’s an excellent choice for anyone looking to take control of their money. If you’re willing to invest the time and money, YNAB can help you build better financial habits and achieve your goals.

FAQs About YNAB

1. Is YNAB free?

No, YNAB requires a subscription. It costs 14.99/monthor14.99/monthor99/year, with a 34-day free trial.

2. Can I use YNAB offline?

No, YNAB is a cloud-based app and requires an internet connection to sync your financial data.

3. How does YNAB compare to Mint?

YNAB offers a proactive budgeting approach, while Mint focuses on tracking past spending. YNAB is ad-free, but it’s more expensive than Mint.

4. Does YNAB support investment tracking?

YNAB offers limited investment tracking. If you need advanced investment features, consider apps like Personal Capital.

5. Is YNAB safe to use?

Yes, YNAB uses bank-level encryption and multi-factor authentication to protect your data.

6. What are the drawbacks of YNAB?

The main drawbacks of YNAB are its steep learning curve, lack of a free plan, limited investment tracking, and higher price compared to some competitors.

7. Can YNAB be trusted?

Yes, YNAB can be trusted. It uses bank-level encryption and doesn’t store your banking credentials, ensuring your data is secure.

8. Is there a better budget app than YNAB?

It depends on your needs. If you prefer a free app with investment tracking, Mint or Personal Capital might be better. If you want a proactive budgeting approach, YNAB is hard to beat.

9. Is YNAB or Mint better?

YNAB is better for proactive budgeting and building financial habits, while Mint is better for tracking spending and managing investments. YNAB is ad-free but comes at a cost, whereas Mint is free but includes ads.

Ready to Take Control of Your Finances?

If you’re looking for a budgeting app that’s both powerful and unique, YNAB is a top contender. Give it a try with their 34-day free trial and see if it’s the right fit for your financial goals. For more budgeting tips and app reviews, stay tuned to easybuget.com!