Have you ever feel like investing has its own secret language? You hear people talk about “growth” and “value” stocks, and it can get a little confusing.

These are two completely different ways of thinking about a company and where its stock might be headed. Getting a handle on them is a big step for anyone looking to invest, whether you are a total beginner or you’ve been doing it for a while.

This guide will break down what these two types of stocks i.e., Growth vs. Value Stocks , are all about and help you figure out which one might be a good fit for your own money goals.

What is a Value Stock?

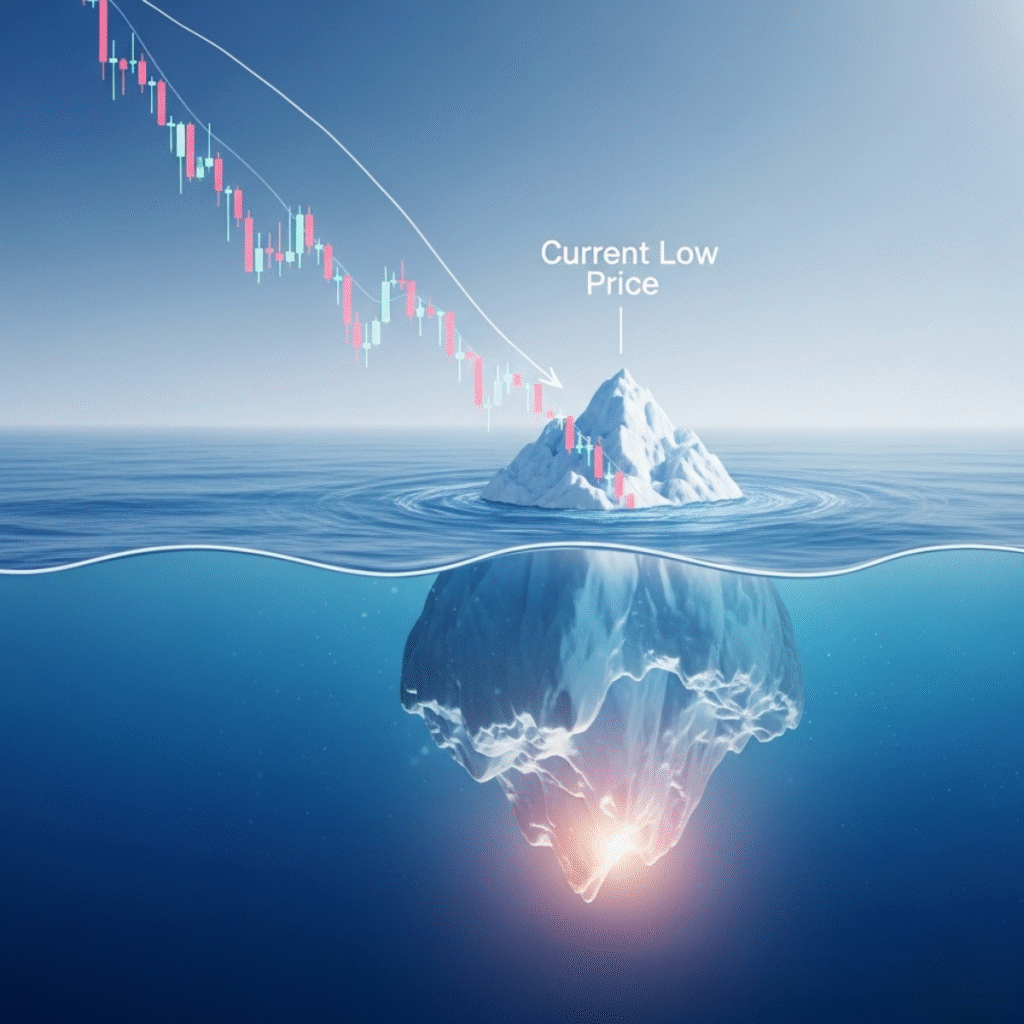

Think of a value stock as a great company on sale. It’s a company that’s been around for a while, has a solid business, and is probably doing just fine, but for some reason, the stock market is not giving it the credit it deserves. The price is lower than what the company is actually worth.

Investors who love value stocks are basically bargain hunters. They believe that sooner or later, the rest of the market will catch on and the stock price will go up. These kinds of companies usually have a few things in common:

- They are not expensive. You can often tell by looking at their price to earnings ratio, which is a key way to see if a stock is cheap or not.

- They are stable. They are not trying to change the world. They are more like a steady, reliable business that brings in consistent money.

- They often pay dividends. A lot of these companies give a portion of their profits back to you as an investor. It’s a nice little bonus you can count on.

A good example of a value company could be a big grocery store chain or a utility company. They are not going anywhere, and they can provide a nice, steady return.

So, in simple terms we can say that:

“A value stock is the equity of a company that appears to be trading at a price lower than its intrinsic or fundamental value.”

This discrepancy is often identified through various financial metrics, such as a low price-to-earnings (P/E) ratio, low price-to-book (P/B) ratio, and a high dividend yield, especially when compared to industry peers or the broader market.

Value investing is an investment strategy that focuses on identifying and purchasing these stocks with the belief that the market will eventually correct their price to reflect their true worth, thereby generating a profit for the investor.

What is Growth Stock?

Growth stocks are a different story altogether. These are the companies that are expected to grow really, really fast.

Unlike value stocks, these are not cheap. Everyone wants a piece of the action. Their prices are high because of all the hype and high hopes for the future. Here are some things that make them stand out:

- They can be pricey. Their price to earnings ratios are usually high because everyone expects huge things from them down the road.

- They do not pay dividends. Instead, they take all their profits and put them right back into the company to grow even faster.

- They can be a rollercoaster ride. Since so much of their value is based on future potential, their stock prices can go up and down pretty dramatically.

Think of a brand new software company or a cutting edge biotech firm. They might not be making a ton of money right now, but the idea is that they will be huge one day.

So, in simple terms we can say that:

“A growth stock is the equity of a company that is expected to grow its revenue, earnings, and cash flow at a significantly faster rate than the average company in its industry or the broader market.”

These companies are typically in their early stages of development or are in innovative, high-growth sectors such as technology, biotechnology, and clean energy.

Investors are willing to pay a premium for these stocks, which is reflected in their high valuation metrics, such as a high price-to-earnings (P/E) ratio.

Unlike value stocks, which are often mature and pay dividends, growth companies typically reinvest all of their profits back into the business to fund expansion and innovation. This focus on future potential rather than current profits makes growth stocks more volatile and carries a higher degree of risk.

The primary goal for an investor in a growth stock is capital appreciation the hope that the stock’s price will rise significantly over time.

Growth vs Value Stocks: A Quick Look

To make things even clearer, here is a simple way to compare them:

| Feature | Value Stocks | Growth Stocks |

| Price | Seems like a good deal | Can feel expensive |

| Business | Mature, well established | New, rapidly expanding |

| Dividends | Often pays them | Rarely pays them |

| Risk | Lower risk, more stable | Higher risk, can be volatile |

| Return | Steady, consistent | Potential for huge gains |

| Investor Focus | Current stability | Future potential |

| Example | A trusted bank | A new streaming service |

Why Pick One Over the Other?

So, should you buy one or the other? The best answer is that it really just depends on you.

Choose Growth if:

- You are young and have a long time before you need the money. You can handle the ups and downs for a chance at bigger returns.

- You are okay with risk. You are not going to freak out if your stock price drops for a little while.

- You want your money to grow as fast as it can.

Choose Value if:

- You are getting closer to retirement. You probably want more stability and maybe some consistent income from dividends.

- You do not like risk. You want to feel more secure about your investments.

- You are looking for some passive income.

What About a Mix?

Most people do not just pick one. They do both! By having a mix of both growth and value stocks in your portfolio, you get the best of both worlds.

- The value stocks can give you a solid foundation and some income, acting like a safety net when the market is shaky.

- The growth stocks can give you that boost you need for long-term growth.

A good mix helps you benefit no matter what the market is doing. When things are great, your growth stocks can soar. When things are tough, your value stocks might hold up better.

A Final Thought

Investing is a personal journey, not a competition. The most important thing is to understand what you want to achieve with your money.

No matter which path you take, always do your homework. Look into the companies you are interested in and make sure you understand what they do. Never invest in something you do not feel comfortable with.

This is not professional financial advice. Always talk to a financial advisor before making any investment decisions.

Related Blog: Blue chip stocks vs Small cap stocks

Please subscribe Easy Budget to stay updated about our latest blogs!