Let’s talk about something that might not feel urgent right now but is absolutely critical for your future: retirement. Did you know that 1 in 3 Americans has less than $5,000 saved for retirement? Scary, right? The truth is, retirement might seem far away, but the sooner you start planning, the better off you’ll be. Whether you’re in your 20s, 40s, or even 50s, it’s never too early or too late to start budgeting for retirement.

In this post, we’ll break down everything you need to know about how to create a retirement budget, setting savings goals, and making smart financial decisions to secure your future. Let’s dive in!

Why budgeting for retirement is important

Retirement might feel like a distant dream, but without a plan, it can quickly turn into a financial nightmare. Imagine reaching your golden years only to realize you don’t have enough saved to live comfortably. The consequences of not planning can include financial stress, dependency on family, or even having to work well into your 70s.

On the flip side, starting early has huge benefits. Thanks to compound interest, even small contributions to your retirement savings can grow significantly over time. But if you wait until 35 to start, you’d only have about $250,000. Time is your best friend when it comes to retirement planning!

How much do you need to retire?

The big question is: how much do you actually need to retire comfortably? A common rule of thumb is the 4% rule, which suggests you’ll need enough savings to withdraw 4% annually to cover your living expenses.

Of course, this number varies depending on your lifestyle, healthcare needs, and where you plan to live. A good starting point is to estimate your annual expenses in retirement and multiply that by 25. Don’t forget to factor in inflation, which can significantly increase your future costs.

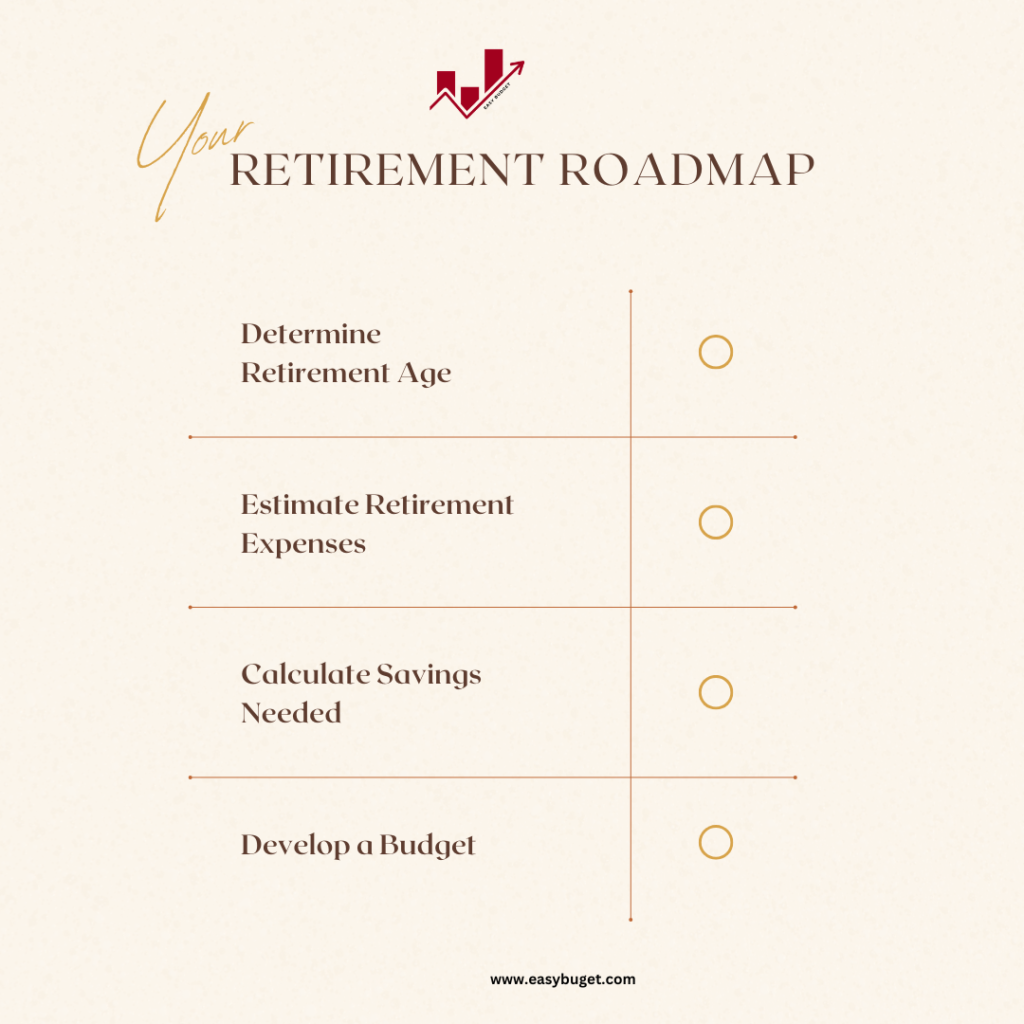

Steps to create a retirement budget

Creating a retirement budget doesn’t have to be complicated. By breaking it down into manageable steps, you can build a plan that works for your unique situation. Here’s a more detailed look at each step:

Step 1: Assess your current financial situation

Before you can plan for retirement, you need a clear picture of where you stand today.

- Track your income and expenses: Use a budgeting app or spreadsheet to record your monthly income and expenses. Categorize your spending (e.g., housing, groceries, entertainment) to identify areas where you can cut back.

- Calculate your net worth: List all your assets (savings, investments, property) and liabilities (debts, loans). Subtract your liabilities from your assets to determine your net worth.

- Review uour savings: How much have you already saved for retirement? Are you contributing to a 401(k), IRA, or other retirement accounts?

Step 2: Set retirement goals

Your retirement goals will shape your savings strategy. Ask yourself:

- When do you want to retire?: The earlier you retire, the more you’ll need to save.

- What kind of lifestyle do you want?: Do you plan to travel, downsize, or stay in your current home?

- How long will retirement last?: With increasing life expectancy, you may need to plan for 20–30 years (or more) of retirement.

Once you’ve answered these questions, estimate your annual retirement expenses. A common rule is to aim for 70–80% of your pre-retirement income, but this can vary depending on your lifestyle.

Step 3: Prioritize retirement savings in your budget

Now that you know how much you need to save, it’s time to make retirement a priority in your budget.

- Follow the 50/30/20 Rule: Allocate 50% of your income to needs, 30% to wants, and 20% to savings (including retirement).

- Start Small if Needed: If saving 15–20% feels impossible, start with a smaller percentage and increase it over time.

- Cut Unnecessary Expenses: Look for areas to trim, like dining out, subscriptions, or impulse purchases. Redirect that money toward retirement savings.

Step 4: Choose the right retirement accounts

Not all retirement accounts are created equal. Here’s a quick breakdown:

- 401(k): Employer-sponsored plan with tax advantages. If your employer offers a match, contribute enough to get the full match—it’s free money!

- IRA (Traditional or Roth): Traditional IRAs offer tax-deferred growth, while Roth IRAs provide tax-free withdrawals in retirement.

- Health savings account (HSA): If you have a high-deductible health plan, an HSA can double as a retirement savings tool. Contributions are tax-deductible, and withdrawals for medical expenses are tax-free.

- Brokerage Accounts: For additional savings, consider investing in a taxable brokerage account.

Step 5: Automate your savings

Automation is the secret to consistent saving.

- Set up automatic transfers: Arrange for a portion of your paycheck to go directly into your retirement accounts.

- Increase contributions over time: Whenever you get a raise or bonus, bump up your retirement contributions.

- Use employer plans: If your employer offers automatic escalation, take advantage of it. This feature gradually increases your 401(k) contributions each year.

Step 6: Adjust your budget over time

Life is unpredictable, and your retirement plan should be flexible.

Stay informed: Keep up with changes in tax laws, retirement account limits, and investment options.

Revisit your budget annually: Review your income, expenses, and savings goals at least once a year.

Adjust for life changes: Got a raise? Add more to retirement. Facing a financial setback? Temporarily reduce contributions, but don’t stop entirely.

Tips for Maximizing Your retirement savings

- Start Early: The earlier you begin, the more time your money has to grow.

- Increase contributions: Whenever you get a raise or bonus, consider putting a portion toward retirement.

- Diversify investments: Spread your money across different types of investments to minimize risk.

- Avoid Early Withdrawals: Withdrawing from your retirement accounts early can result in penalties and lost growth.

Common Retirement budgeting mistakes to avoid

- Underestimating healthcare costs: Healthcare can be one of the biggest expenses in retirement. Plan for it!

- Relying solely on social security: Social Security is helpful, but it’s not enough to live on comfortably.

- Ignoring inflation: Prices rise over time, so factor inflation into your savings goals.

- Not adjusting your plan: Life changes, and so should your retirement strategy.

Tools and resources to help you plan

Planning for retirement is easier when you have the right tools and resources at your fingertips. Here are some of the best options to help you stay on track:

Budgeting tools

- Mint: A free app that tracks your spending, creates budgets, and helps you set savings goals.

- You Need a Budget (YNAB): A paid app that focuses on giving every dollar a job, helping you prioritize retirement savings.

- Personal Capital: Combines budgeting with investment tracking, making it a great tool for retirement planning.

Retirement calculators

- NerdWallet Retirement Calculator: Estimates how much you need to save based on your age, income, and retirement goals.

- EasyBudget 401k Retirement calculator: Calculates balance at 65, Investments returns etc.

- Fidelity Retirement Score: Provides a snapshot of your retirement readiness and suggests ways to improve.

- Vanguard Retirement Nest Egg Calculator: Helps you determine how long your savings will last in retirement.

Investment platforms

- Betterment: A robo-advisor that creates a personalized retirement plan and manages your investments for you.

- Vanguard: Offers low-cost index funds and retirement accounts with expert guidance.

- Charles Schwab: Provides a range of investment options and retirement planning tools.

Educational Resources

- Books:

- Websites:

- Investopedia: Offers easy-to-understand articles on retirement planning.

- The Balance: Provides practical tips and guides for budgeting and saving.

- AARP: Focuses on retirement planning for older adults.

- Podcasts:

Professional Help

- Financial advisors: A certified financial planner (CFP) can create a personalized retirement plan tailored to your goals.

- Employer resources: Many companies offer retirement planning workshops or one-on-one consultations.

- Online communities: Join forums like Reddit’s r/personalfinance or r/financialindependence to learn from others’ experiences.

Final thoughts

Creating a retirement budget is one of the most important steps you can take to secure your financial future. By assessing your current situation, setting clear goals, and using the right tools, you can build a plan that works for you. Remember, it’s never too early or too late to start. Every dollar you save today brings you closer to the retirement of your dreams.

What’s your favorite tool or resource for retirement planning? Share in the comments below—I’d love to hear what’s working for you!

Please subscribe Easy Budget to stay updated about our latest blogs!