College life is an exciting chapter, full of new experiences, learning, and making lifelong friends. But it can also be a huge drain on your wallet. Between tuition, books, living expenses, and trying to have a social life, money can disappear faster than you can say “student loan.”

There are tons of smart ways to keep more cash in your pocket without missing out on the college experience. This short comprehensive guide will walk you through practical strategies on how to save money in college, helping you manage your finances like a pro and maybe even graduate with less debt.

Getting Started: Your Financial Foundation

Before diving into specific saving tactics, laying a strong groundwork is key.

1. Create a Budget (and Actually Stick to It!)

This is perhaps the most crucial step. A budget is simply a plan for your money. It helps you see what is coming in (income) and what is going out (expenses).

- List Your Income: This includes money from parents, scholarships, grants, and any part time jobs.

- Track Your Expenses: Be honest here. Include tuition, rent, groceries, transportation, textbooks, and yes, even your entertainment money.

- Find Your Balance: Does more money go out than come in? Time to make some adjustments!

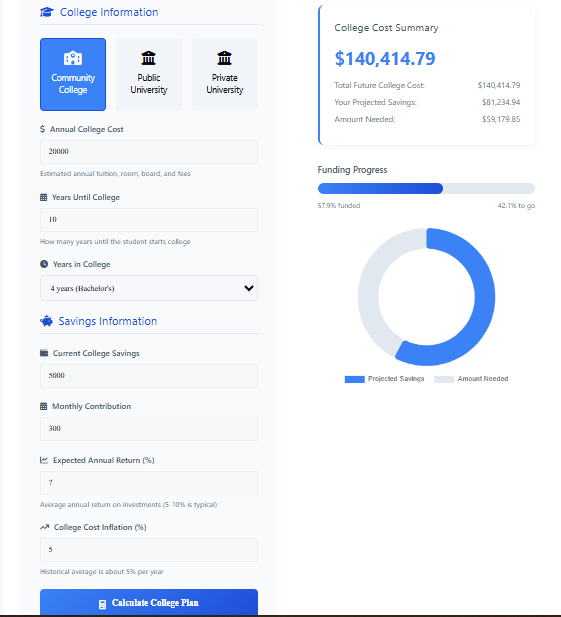

To calculate your budget use our free College Savings Calculator

2. Track Your Spending

A budget is only as good as the information you put into it. For a month or two, write down every single penny you spend. You can use a simple notebook, a spreadsheet, or a budgeting app. Seeing where your money actually goes can be a huge eye opener and help you identify areas to cut back.

Download Free Expense Tracker from our free Budget Templates.

3. File the FAFSA Every Year

Even if you do not think you will qualify for aid, always file the Free Application for Federal Student Aid (FAFSA). This form opens the door to federal grants, scholarships, work study programs, and low interest student loans. You never know what you might be eligible for until you apply. Make it an annual tradition!

Smart Spending on Necessities: Tuition, Books, and Housing

These are usually your biggest expenses. Being strategic here can lead to massive savings.

4. Apply for Scholarships (Seriously, Do It!)

Scholarships are free money you do not have to pay back! Many students only think about scholarships when they first apply to college, but there are countless scholarships available throughout your entire college career.

Look for opportunities based on your major, hobbies, heritage, academic performance, or even unique talents. Dedicate time each week to searching and applying. Every dollar earned through a scholarship is a dollar you do not have to borrow or earn elsewhere.

5. Buy Used Textbooks (or Avoid Buying Them Altogether)

New textbooks are ridiculously expensive. Do not buy them without checking alternatives first.

- Rent Textbooks: Many online services (and even your campus bookstore) allow you to rent textbooks for a fraction of the purchase price.

- Buy Used: Check campus bulletin boards, online marketplaces (like Amazon, Chegg, Half.com), or your university’s own used book sales.

- Use the Library: Your campus library might have copies of required texts. Get there early to borrow them!

- Digital Versions: E-textbooks are often cheaper and more convenient.

- Ask Your Professor: Sometimes, older editions are perfectly fine, or the professor might not even use the book much.

6. Choose Housing Wisely (On or Off Campus)

Your living situation significantly impacts your budget.

- On-Campus (RA Role): If living on campus, consider becoming a Resident Advisor (RA). Many RA positions offer free or heavily discounted room and board in exchange for your duties. This can save you thousands each semester.

- Off-Campus (Roommates): If you choose to live off-campus, getting roommates is almost always the most cost effective option. Splitting rent, utilities, and internet dramatically reduces your individual expenses.

- Commuting: If feasible, living at home and commuting can eliminate rent and utility costs entirely, though you will need to factor in transportation.

7. Use Campus Amenities

Your tuition often covers access to fantastic resources you might not even realize. Exploit them!

- Gym and Fitness Centers: Cancel that off-campus gym membership you might have.

- Libraries: Not just for textbooks! Use their computers, printers, study spaces, and even movie or music rentals.

- Student Health Services: Most campuses offer affordable (or free) medical consultations, mental health services, and sometimes even prescriptions.

- Career Services: Get help with resume writing, interview skills, and job searching without paying an external consultant.

Everyday Savings: Food, Transportation, and Fun

These are the areas where small changes add up quickly.

8. Meal Plan and Cook at Home (Cut Food Costs)

Eating out and getting takeout are huge budget busters for college students.

- Plan Your Meals: Spend an hour each week planning your breakfasts, lunches, and dinners.

- Buy in Bulk: For non-perishables and frequently used items, buying larger quantities can be cheaper per unit. Think rice, pasta, canned goods, and frozen veggies.

- Brew Your Own Coffee: That daily latte adds up to hundreds of dollars a semester. Invest in a good coffee maker and make your own.

- Limit Meals Out (Do Limit Meals Out): When you do eat out, look for student discounts or happy hour deals. Maybe make it a treat once a week instead of an everyday habit.

9. Take Public Transportation (Avoid Having a Car on Campus)

Having a car on campus comes with a lot of hidden costs: gas, insurance, parking permits, maintenance, and potential tickets.

- Public Transit: Most colleges have excellent public transportation options, often free for students with an ID.

- Biking/Walking: Great for your health and your wallet!

- Ride-Sharing (Limited): Use services like Uber or Careem only when absolutely necessary, or for group outings where you split the cost.

10. Exploit Student Discounts

Your student ID is a superpower! Always ask if a business offers a student discount. Many places do, from restaurants and clothing stores to software companies and museums. Websites like UniDays or Student Beans list countless deals.

11. Use Coupons and Sales

It might seem old school, but coupons still work! Look for digital coupons on grocery store apps, browse weekly flyers, and shop sales. Combine coupons with sales for maximum savings.

12. Attend Campus Events

Colleges often host free events, concerts, movie nights, workshops, and even free food giveaways. These are fantastic ways to have fun and socialize without spending a dime. Check your university’s event calendar regularly.

Earning While Learning: Boosting Your Income

Sometimes, cutting expenses just isn’t enough. Bringing in more money can significantly ease the financial burden.

13. Work Part-Time / Get a Job

Even a few hours a week can make a big difference. Look for jobs on campus (like in the library, cafeteria, or as a tutor) as they are often flexible with student schedules and commute times are non-existent. Off-campus jobs can also work, but prioritize flexibility. Remember to balance work with your studies!

Mindful Money Management: Preventing Debt

14. Avoid Using Credit Cards (Unless You Can Pay it Off)

Credit cards can be incredibly tempting in college, but carrying a balance means paying high interest rates, which just makes everything more expensive. If you must use one, treat it like a debit card: only spend money you already have and pay the full balance on time every month. This builds good credit without costing you extra.

15. Visit Your Local Bank (or Online Bank)

Choose a bank that offers student friendly checking and savings accounts, often with no monthly fees and sometimes higher interest rates for savings. Building a relationship with a bank can also be helpful for future financial needs.

Your Journey to Financial Freedom in College

Saving money in college is not just about pinching pennies; it is about building smart financial habits that will serve you well for the rest of your life. It takes discipline and effort, but every single strategy you implement puts you in a better financial position.

Remember, you are investing in your future by getting an education. By also investing in smart money management now, you are setting yourself up for even greater success down the road. You have got this!

Please subscribe Easy Budget to stay updated about our latest blogs!