Do you find it hard to stay on top of your personal finances?

Many people struggle with budgeting, saving, or planning for financial goals. But what if you had a tool that could help you manage your money, anytime, without the need to be a finance expert?

YES, that is ChatGPT!

ChatGPT is more than a chatbot. It’s an AI tool that can help you organize your budget, track expenses, plan savings, and even explain financial concepts in simple words.

In this blog post, you’ll learn how to manage your personal finance using ChatGPT and yes step by step. These are real, practical uses, based on how people are already using AI to improve their money habits.

What Is ChatGPT and How Can It Help You With Personal Finance?

ChatGPT is an artificial intelligence assistant developed by OpenAI. It can answer your questions, generate text, help you solve problems, and provide suggestions based on the prompts you give.

When it comes to personal finance, ChatGPT can:

- Create custom budgets

- Help you understand financial terms

- Suggest ways to save money

- Organize your monthly expenses

- Offer general investment ideas (without specific financial advice)

Note: ChatGPT is not a certified financial advisor. It gives general suggestions, so you should always double-check with a licensed professional when making major financial decisions.

Real Ways People Use ChatGPT to Manage Their Finances

These aren’t theories. These are actual, tested methods used by people today:

1. Creating a Monthly Budget

You can ask ChatGPT:

“Create a simple monthly budget for someone earning $3000 after taxes with fixed rent, utilities, groceries, and a savings goal.”

ChatGPT will break down your budget based on common spending rules like the 50/30/20 rule (50% needs, 30% wants, 20% savings). You can adjust categories and ask follow-up questions.

People on Reddit and budgeting forums have shared real screenshots of ChatGPT creating monthly budgets that helped them stay accountable.

2. Tracking and Categorizing Expenses

Let’s say you list your expenses from last month in a rough format:

$900 – Rent

$250 – Groceries

$120 – Eating out

$60 – Netflix, Spotify

$300 – Debt payment

You can copy and paste this into ChatGPT and ask:

“Please categorize my expenses and tell me what percent of my income each category uses.”

ChatGPT quickly calculates percentages and categorizes them—making it easier for you to understand where your money is going.

3. Building a Debt Payoff Plan

People have used ChatGPT to help outline plans using proven debt strategies like:

- Debt Snowball – Pay smallest debt first for motivation

- Debt Avalanche – Pay highest-interest debt first for savings

Prompt example:

“Help me create a debt snowball plan. I have three debts: $500 (5%), $2000 (10%), $4000 (15%). My monthly budget allows $600 toward debt.”

ChatGPT returns a clear, step-by-step payoff plan showing which debt to tackle first and when you’ll be debt-free—based on your numbers.

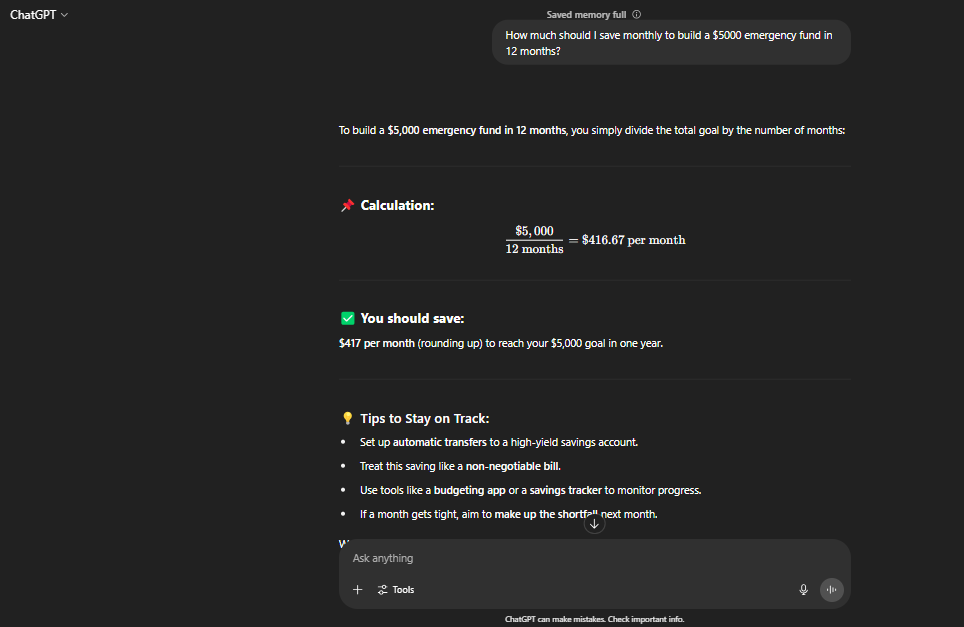

4. Setting Up Financial Goals

Whether it’s saving for an emergency fund or a vacation, you can ask:

“How much should I save monthly to build a $5000 emergency fund in 12 months?”

ChatGPT will give a clear answer:

$417/month for 12 months = $5,004

It may even recommend tools like high-yield savings accounts to speed up your progress.

5. Learning Financial Terms in Simple English

Not sure what “compound interest” or “index fund” means? Ask ChatGPT:

“Explain compound interest in simple words, like I’m 12.”

You’ll get a short, clear answer without confusing jargon—just like a good teacher would explain it. This is perfect for beginners building financial literacy.

6. Creating a Weekly Spending Plan

Ask:

“Help me plan my weekly spending. I get $500/week after taxes. I have to pay $200 rent and $50 for transportation. I want to save $100. What should I spend on food and fun?”

ChatGPT calculates and divides your money based on your goals. It even leaves room for flexibility and helps you understand your priorities.

Why Use ChatGPT for Money Management?

✅ 1. It Saves Time

No need for spreadsheets or apps, you can ask ChatGPT in plain English and get instant results.

✅ 2. It’s Free

You don’t have to pay for budgeting software. Even the free version of ChatGPT can do most finance tasks.

✅ 3. It Works 24/7

Do you need help on a Sunday night or during your lunch break? ChatGPT is always available.

✅ 4. It Improves Your Money Confidence

The more you interact with it, the more you understand how money works. You ask. It explains. You apply.

Limitations to Know

- It’s not a human expert. ChatGPT doesn’t know your full financial situation.

- It may not account for taxes or region-specific fees.

- It cannot replace certified financial advice.

Always use ChatGPT as a helper not your final decision-maker.

Prompts You Can Try Today

Try these real prompts to get started:

🟢 “Make a budget for someone earning $3500/month.”

🟢 “Give me 5 ways to save $100 per month on food.”

🟢 “Create a debt avalanche plan for 3 loans: $1000 at 18%, $2000 at 12%, $3000 at 9%.”

🟢 “Explain what a 401(k) is in simple terms.”

🟢 “I want to save $10,000 in 2 years. How much should I save each month?”

Final Thoughts

ChatGPT is a powerful tool that can manage your personal finances easier, faster, and less stressful. While it’s not a financial advisor, it’s like having a smart assistant that helps you:

- Budget better

- Track spending

- Set financial goals

- Learn money concepts

- Build confidence

Start small: Ask ChatGPT to make a weekly or monthly budget for you. Then use it to track your progress and adjust as you go.

You don’t need to be rich to be in control of your finances. You just need the right habits and the right tools. ChatGPT is one of them.

Do you liked this post? Share it with a friend who wants to improve their money habits.

Want more? Check out these helpful guides:

Please subscribe Easy Budget to stay updated about our latest blogs!