Tax planning is the process of organizing your finances in a way that minimizes the amount of tax you have to pay, all within the legal framework. This approach allows you to maximize your savings and use your money more effectively. Tax planning can sound complex, but in simple terms, it’s about making the most of tax deductions, credits, and tax-efficient investments to keep more of your income.

Why is Tax Planning Important?

Tax planning is crucial for several reasons:

- Maximizing Savings: By taking advantage of available tax benefits, you can reduce your tax burden, leaving you with more disposable income. This money can be reinvested, saved, or used to fund personal goals, like travel, education, or retirement.

- Achieving Financial Goals: Effective tax planning aligns with your broader financial objectives, such as saving for a home, funding education, or building retirement savings. With good planning, you can reach these goals sooner.

- Staying Legally Compliant: Following tax laws carefully ensures that you don’t face penalties or legal issues. Tax planning helps you remain compliant while benefiting from legal tax-saving opportunities.

- Reducing Tax Liability: Tax planning focuses on reducing the taxes you owe, allowing you to enjoy more of your earnings. This is achieved through strategic decisions about deductions, credits, and investment choices.

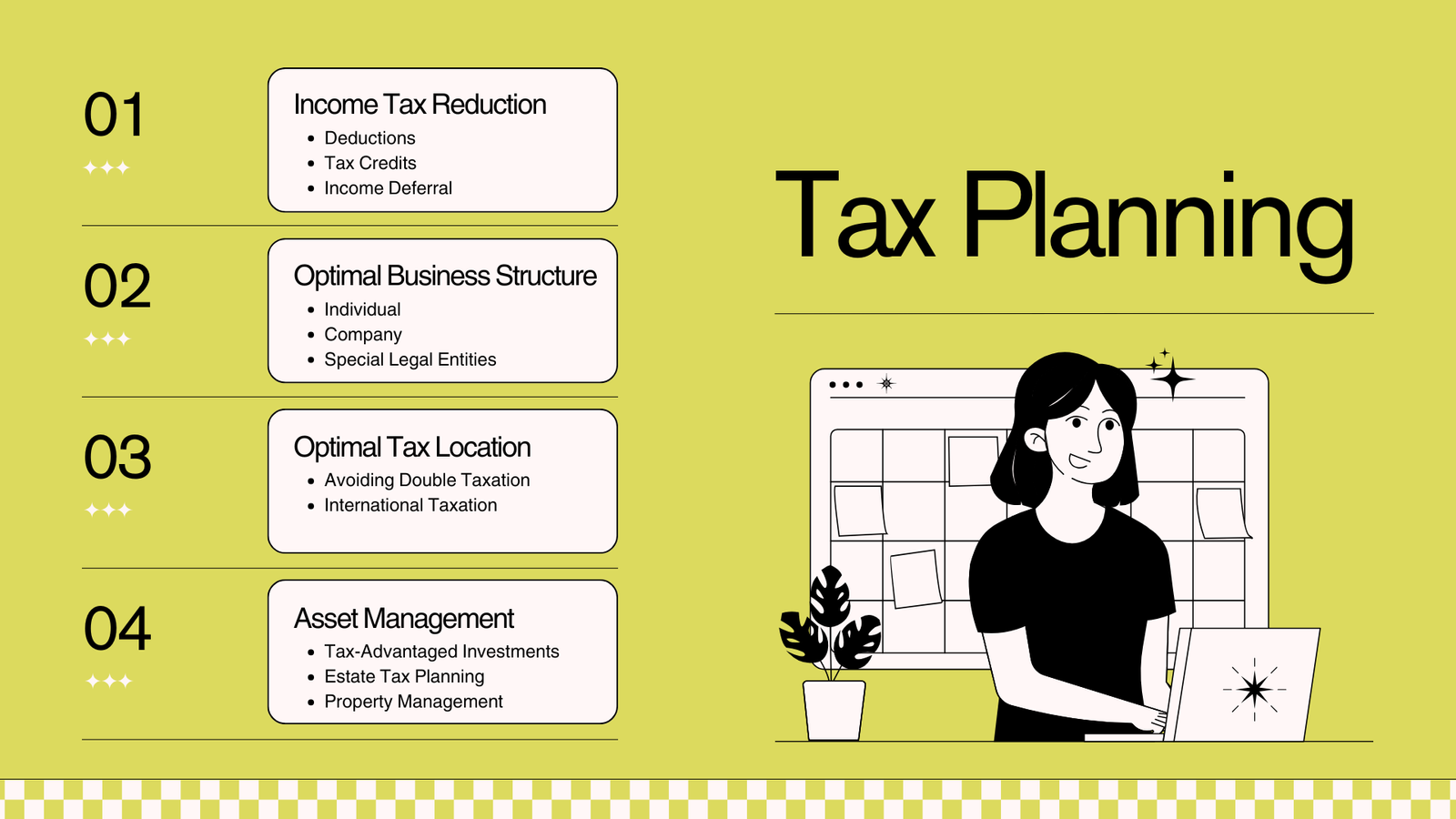

Key Components of Tax Planning

To understand tax planning, it’s important to look at the main strategies used to lower taxable income and, in turn, tax liability. Here are some of the most common elements:

- Income Management: The way and timing in which you receive your income can have an impact on the taxes you owe. For instance, you might defer a bonus to the next tax year if it keeps you in a lower tax bracket, reducing the overall tax you’ll pay.

- Investments: Certain investments provide tax benefits. For instance, investing in tax-saving bonds, mutual funds, or retirement accounts can lower your taxable income. In some cases, you may earn tax-free interest or get tax deductions for contributions to retirement plans. To learn more about maximizing retirement savings, check out Fidelity’s retirement planning page.

- Deductions and Credits: Tax deductions lower your taxable income, while tax credits directly reduce the amount of tax you owe. Examples of deductions include those for mortgage interest, charitable contributions, and student loan interest. Credits might include those for education expenses, dependent care, and energy-efficient home improvements.

Types of Tax Planning

Tax planning strategies vary depending on your financial situation, goals, and the time frame you’re considering. Here are four main types of tax planning:

- Short-term Tax Planning: This involves strategies that apply within the current tax year, aiming to reduce your tax burden quickly. For example, you might invest in tax-saving schemes or claim available deductions and credits by year-end.

- Long-term Tax Planning: This type focuses on setting up financial structures for future tax benefits. It involves planning over multiple years, often using investment vehicles like retirement accounts (e.g., IRAs, 401(k)s) that offer tax deferrals or deductions.

- Permissive Tax Planning: Here, you make full use of the tax-saving options available under the law. For instance, investing in government-approved tax-saving schemes or selecting tax-efficient assets for your portfolio.

- Purposive Tax Planning: This form of planning is aimed at a specific goal, such as reducing estate taxes through trusts or using gifts to reduce taxable income. It’s more strategic and can involve complex financial arrangements.

Common Tax-Saving Strategies

Tax planning typically involves implementing some of these strategies:

- Contributing to Retirement Accounts: Retirement accounts like 401(k)s, IRAs, and Roth IRAs offer significant tax benefits. Traditional 401(k) contributions, for example, are pre-tax, which means they reduce your taxable income for the year. Roth IRAs, on the other hand, don’t offer an immediate tax break but grow tax-free, meaning you won’t pay taxes on the withdrawals during retirement. For more information on retirement savings options, check out Fidelity’s retirement planning resources.

- Health Savings Accounts (HSAs): HSAs are designed for individuals with high-deductible health plans and offer a triple tax advantage: contributions are tax-deductible, growth is tax-free, and withdrawals for medical expenses are also tax-free. Learn more about HSAs at HealthSavings.com.

- Charitable Contributions: Donations to registered charitable organizations can be tax-deductible, helping you reduce your taxable income. If you itemize deductions, these contributions can add up to a significant tax benefit.

- Using Tax-Advantaged Investment Accounts: Investment accounts like 529 plans (for education) or tax-free bonds can offer tax savings. Municipal bonds, for example, provide tax-free interest income, which can be especially valuable for individuals in higher tax brackets.

- Tax-Loss Harvesting: If you have investments in taxable accounts, you can offset capital gains by selling securities at a loss. This strategy, called tax-loss harvesting, can help lower your taxable income and reduce the taxes owed on investment gains. For a detailed guide on tax-loss harvesting, check out SmartAsset’s Tax-Loss Harvesting Guide.

How to Start with Tax Planning?

If you’re new to tax planning, here are some practical steps to get started:

- Assess Your Financial Situation: Look at your income, expenses, and current investments. This will help you identify where tax-saving opportunities may exist.

- Set Clear Goals: Decide what you want to achieve with tax planning. For example, do you want to save for retirement, buy a home, or reduce student loan debt? Your goals will help guide your tax-saving strategies.

- Learn About Tax-Saving Options: Familiarize yourself with tax-saving investments, deductions, and credits. Resources like financial websites and tax advisors can be helpful. You can also access a comprehensive tax planning guide from the IRS for detailed strategies.

- Seek Professional Help: A tax advisor or financial planner can guide you through more complex strategies, ensuring that you’re optimizing your finances while staying compliant with tax laws. Websites like NerdWallet’s financial planning tools offer a great starting point to guide your decisions.

- Stay Updated on Tax Law Changes: Tax laws change regularly, so staying informed can help you make timely adjustments to your tax planning strategies.

Final Thoughts

Tax planning doesn’t need to be complicated. By understanding the basics and using a few straightforward strategies, you can reduce your tax liability and keep more of your hard-earned money. It’s all about making informed choices and using the tax benefits available to you.

Effective tax planning can help you reach your financial goals faster, all while ensuring compliance with tax laws. Whether you’re saving for the future, managing investments, or just trying to reduce your annual tax bill, tax planning can play a key role in improving your financial well-being. For complete knowledge about financial education your can click here.

This expanded blog post covers the fundamental aspects of tax planning in a way that’s easy to understand, helping readers get started with managing their taxes more effectively.

Please subscribe Easy Budget to stay updated about our latest blogs!