If you’ve ever thought about diversifying your investment portfolio, the Australian Securities Exchange (ASX) might have caught your eye. As one of the top 15 largest stock exchanges in the world, the ASX is home to some of the most stable and high-performing companies globally. But what exactly is the ASX, and how can you start investing in Australian stocks?

In this post, we’ll break it all down for you. Whether you’re a beginner or an experienced investor looking to explore new markets, this guide will walk you through everything you need to know about the ASX and how to get started. Let’s dive in!

What is the ASX?

The Australian Securities Exchange (ASX) is the primary stock exchange in Australia, founded in 1987. It’s where shares, ETFs, bonds, and other securities are traded. With a market capitalization of over $2 trillion, the ASX is a major player in the global financial market.

But the ASX isn’t just about stocks—it’s also a hub for innovation, offering trading in derivatives, commodities, and even blockchain-based assets. Whether you’re interested in blue chip companies or emerging startups, the ASX has something for everyone.

Why tp invest in the ASX?

So, why should you consider investing in the ASX? Here are a few compelling reasons:

- Diversification: The ASX offers exposure to a wide range of sectors, from mining and finance to healthcare and technology.

- Strong economy: Australia’s stable economy and resource-rich landscape make it an attractive market for investors.

- High dividend yields: Australian companies are known for their generous dividend payouts, making the ASX a favorite among income-focused investors.

- Global influence: Many ASX-listed companies, like BHP and CSL, operate internationally, giving you global exposure without leaving the exchange.

In short, the ASX is a gateway to one of the most robust and dynamic markets in the world.

Key sectors and Companies on the ASX

The ASX is home to some of the biggest names in various industries. Here’s a quick overview of the key sectors and standout companies:

- Mining and resources: Australia is a global leader in mining, with giants like BHP Group and Rio Tinto dominating the sector.

- Financials: Major banks like Commonwealth Bank and Westpac are ASX heavyweights, offering stability and consistent dividends.

- Healthcare: CSL Limited, a global biotechnology leader, is one of the ASX’s top-performing stocks.

- Technology: Fintech companies like Afterpay (now part of Block Inc.) have put the ASX on the map for tech investors.

- ETFs: If you’re looking for broad market exposure, ETFs like the Vanguard Australian Shares Index ETF (VAS) are a great option.

How to invest in the ASX

Ready to start investing in the ASX? Here’s a step-by-step guide to help you get started:

Step 1: Choose a broker

To trade on the ASX, you’ll need an online broker. Some popular options include:

- CommSec: A user-friendly platform for Australian residents.

- Interactive brokers: Great for international investors.

- eToro: Offers commission-free trading and a social trading feature.

When choosing a broker, consider factors like fees, platform usability, and research tools.

Step 2: Open a trading account

Once you’ve chosen a broker, you’ll need to open a trading account. This usually involves:

- Providing personal information (e.g., name, address, tax file number).

- Verifying your identity with documents like a passport or driver’s license.

- Funding your account with an initial deposit.

Step 3: Research ASX stocks

Before buying any stocks, do your homework. Use tools like Morningstar, Yahoo Finance, and the ASX website to analyze companies. Look at factors like:

- Financial performance (e.g., revenue growth, profit margins).

- Dividend history.

- Industry trends and competitive advantages.

Step 4: Place your first trade

Once you’ve identified a stock you want to buy, it’s time to place your trade. Here’s how:

- Log in to your broker’s platform.

- Enter the stock’s ticker symbol (e.g., CBA for Commonwealth Bank).

- Choose the type of order (e.g., market order, limit order).

- Specify the number of shares you want to buy.

- Review and confirm your trade.

Step 5: Monitor and Manage your portfolio

Investing isn’t a “set it and forget it” activity. Regularly review your portfolio to ensure it aligns with your goals. Consider strategies like:

- Diversification: Spread your investments across different sectors.

- Rebalancing: Adjust your portfolio periodically to maintain your desired asset allocation.

Tips for investing in the ASX

Here are some tips to help you succeed as an ASX investor:

- Start small: Begin with a diversified ETF or a few blue-chip stocks.

- Stay informed: Follow ASX news, company announcements, and economic trends.

- Think long term: Focus on quality companies with strong fundamentals.

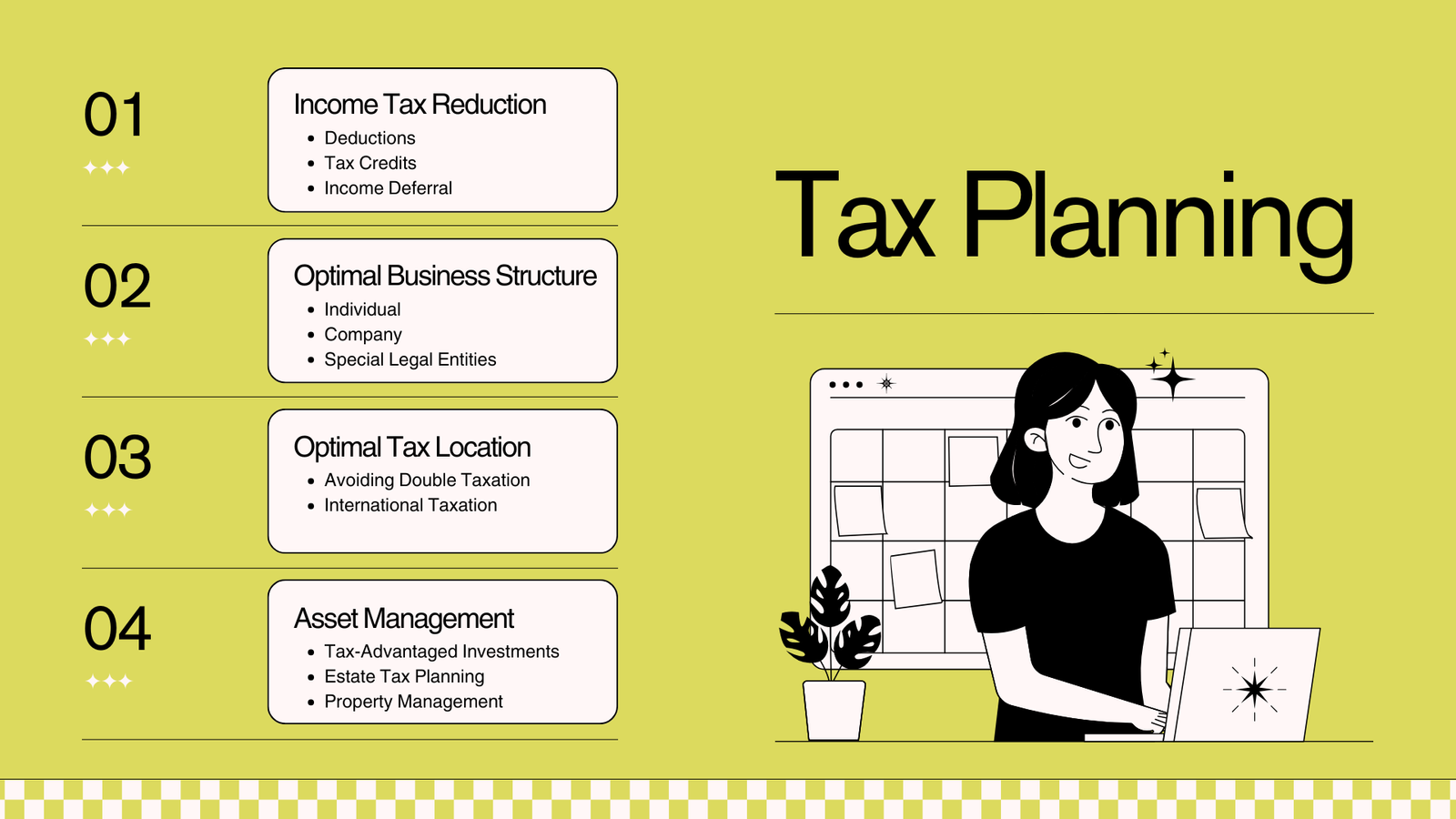

- Understand tax implications: Be aware of capital gains tax and dividend imputation in Australia.

Risks of investing in the ASX

Like any investment, the ASX comes with risks:

- Market volatility: The ASX can be affected by global economic events and commodity price fluctuations.

- Currency risk: For international investors, exchange rate changes can impact returns.

- Sector concentration: The ASX is heavily weighted toward mining and finance, which can increase risk.

Tools and resources for ASX investors

To help you on your investment journey, here are some must-have resources:

- ASX website: The official source for market data and company announcements.

- Trading platforms: CommSec, SelfWealth, and Interactive Brokers.

- Research tools: Morningstar, Yahoo Finance, and Simply Wall St.

- News outlets: The Australian Financial Review and Bloomberg.

Final thoughts on ASX

The ASX is a fantastic opportunity for investors looking to diversify their portfolios and tap into one of the world’s most stable and dynamic markets. With this guide, you’re well-equipped to start your ASX investment journey.

So, what are you waiting for? Choose a broker, open an account, and take the first step toward investing in Australian stocks today. And if you have any questions or want to share your ASX experiences, drop a comment below—I’d love to hear from you!

Please subscribe Easy Budget to stay updated about our latest blogs!