Managing finances as a couple can be both rewarding and challenging. Whether you’re saving for a dream vacation, planning to buy a home, or simply trying to avoid arguments over spending habits, budgeting apps can be a game-changer. In 2025, the world of financial technology has evolved, offering couples more tools than ever to streamline their money management.

This comprehensive guide will walk you through everything you need to know about best budget apps for couples, from why they’re essential to how to choose the right one for your relationship. We’ll also explore topics that other blogs haven’t covered, ensuring you have all the information you need to take control of your finances together.

Why To Need The Best Budget Apps For Couples

The Challenges of Managing Finances as a Couple

Let’s face it—money is one of the most common sources of conflict in relationships. Differing spending habits, unequal incomes, and a lack of transparency can lead to misunderstandings and stress. Without a clear system in place, it’s easy to lose track of shared expenses, miss bill payments, or fail to save for future goals.

The Benefits of Using The Best Budget Apps for Couples

Budgeting apps are designed to simplify financial management by providing tools that promote transparency, collaboration, and accountability. Here’s how they can help:

- Real-Time Updates: Both partners can see transactions and account balances instantly.

- Shared Accountability: Tracking spending together encourages responsible financial behavior.

- Collaborative Goal Setting: Apps make it easy to set and achieve shared financial goals, like saving for a house or paying off debt.

How Budgeting Apps Strengthen Relationships

By fostering open communication and reducing financial stress, budgeting apps can actually strengthen your relationship. When both partners are on the same page about money, it’s easier to focus on building a life together.

Key Features to Look for in Budget Apps for Couples

Not all budgeting apps are created equal. Here are the features you should prioritize when choosing one for your relationship:

1. Shared Accounts and Real-Time Syncing

The best budget apps for couples should allow both partners to link their accounts and view transactions in real time. This ensures transparency and makes it easier to track shared expenses.

2. Expense Tracking and Categorization

Look for apps that automatically categorize expenses, so you can see where your money is going. This is especially useful for identifying areas where you can cut back.

3. Bill Reminders and Alerts

Never miss a payment again! Apps with bill reminders and alerts help you stay on top of due dates and avoid late fees.

4. Financial Goal Setting

Whether you’re saving for a wedding, a vacation, or a down payment on a house, your app should help you set and track financial goals.

5. Ease of Use and Compatibility

A user-friendly interface and cross-platform compatibility are essential. After all, you don’t want to spend hours figuring out how to use the app.

6. Security and Privacy

Your financial data should be protected with robust security measures, such as encryption and two-factor authentication.

Top Best Budget Apps For Couples in 2025

1. Monarch money

Monarch money budgeting app is spatially designed for couples who value detailed insights into their finances. It allows both partners to log in with individual credentials, ensuring privacy while maintaining a shared financial overview. Monarch syncs with over 11,000 financial institutions, pulling in data from bank accounts, loans, and credit cards to provide a comprehensive picture of your financial health.

Why Couples Love It:

- User-friendly dashboards for tracking expenses.

- Customizable budgets for shared and individual goals.

- Seamless integration with financial accounts.

Best For:

Couples who are detail-oriented and want in-depth financial analyses.

monarch money pricing

Monthly : $8.33

Yearly: $99.99

or check live pricing from website.

Want to register? Click here.

2. Honeydue

Honeydue is specifically designed with couples in mind. The app allows you to share selected financial information—such as bank accounts, credit cards, and loans, while keeping certain details private if needed. It is an excellent tool for tracking expenses, setting shared budgets, and ensuring transparency in your financial journey.

Why Couples Love It:

- Customizable account sharing settings.

- Alerts for upcoming bills to avoid missed payments.

- Support for over 20,000 financial institutions across multiple countries.

Best For:

Couples who want to balance transparency with privacy.

Want to signup on Honeydue? Click here.

3. You Need a Budget (YNAB)

You Need a Budget, or YNAB, takes a proactive approach to budgeting. Using the zero-based budgeting system, it encourages users to assign every dollar a job. YNAB offers real-time syncing between devices, making it easy for couples to stay on the same page about their financial priorities.

Why Couples Love It:

- Real-time updates for shared expenses.

- Goal-setting features for short- and long-term objectives.

- Extensive educational resources to improve financial literacy.

Best For:

Couples who want a structured, hands-on budgeting system.

want to signup on Ynab? Click here.

4. Goodbudget

Goodbudget brings the classic envelope budgeting method into the digital age. This app allows couples to allocate money into virtual envelopes for different spending categories, making it easy to visualize where your money is going. It’s a great choice for those who prefer a straightforward approach to budgeting.

Why Couples Love It:

- Simple envelope-based system for expense tracking.

- Easy-to-share budgets for collaborative financial management.

- Reports that provide insights into spending habits.

Best For:

Couples who prefer simplicity and a visual budgeting method.

want to sign up on Goodbudget? Click here.

5. Albert

Albert is more than just a budgeting app; it’s a full-fledged financial assistant. Couples can use it to track expenses, manage shared budgets, and even receive personalized advice from human financial experts. Albert also offers investment options and identity protection, making it a versatile tool for couples looking to manage their finances comprehensively.

Why Couples Love It:

- Personalized financial advice tailored to your goals.

- Automatic savings features to help you reach milestones faster.

- Options for investment and cash flow management.

Best For:

Couples who want an all-in-one solution with expert guidance.

want to signup on Albert app? Click here.

How to Choose the Right Budget Apps for Your Relationship

With so many options available, choosing the right budgeting app can feel overwhelming. Here’s a step-by-step guide to help you decide:

1. Assess Your Financial Goals

Are you saving for a big purchase, paying off debt, or simply tracking expenses? Different apps cater to different needs, so it’s important to choose one that aligns with your goals.

2. Consider Your Budgeting Style

Do you prefer automated tracking or manual input? Some apps, like YNAB, require more hands-on effort, while others, like Mint, automate most of the process.

3. Evaluate Compatibility

Make sure the app works on both partners’ devices and integrates with your bank accounts.

4. Test the App

Take advantage of free trials or basic versions to see if the app meets your needs before committing.

5. Discuss as a Couple

Budgeting is a team effort, so it’s important that both partners are comfortable with the chosen app.

Tips for Using Budgeting Apps Effectively as a Couple

1. Set Clear Financial Goals Together

Define short-term and long-term objectives, such as saving for a vacation or paying off student loans.

2. Schedule Regular Money Check-Ins

Set aside time each week or month to review your budget, track progress, and make adjustments as needed.

3. Be Transparent About Spending

Avoid financial secrets and build trust by being open about your spending habits.

4. Celebrate Milestones

Acknowledge achievements, like paying off a credit card or reaching a savings goal, to stay motivated.

5. Adapt as Your Needs Change

Your financial situation will evolve over time, so be prepared to update your budgeting strategy accordingly.

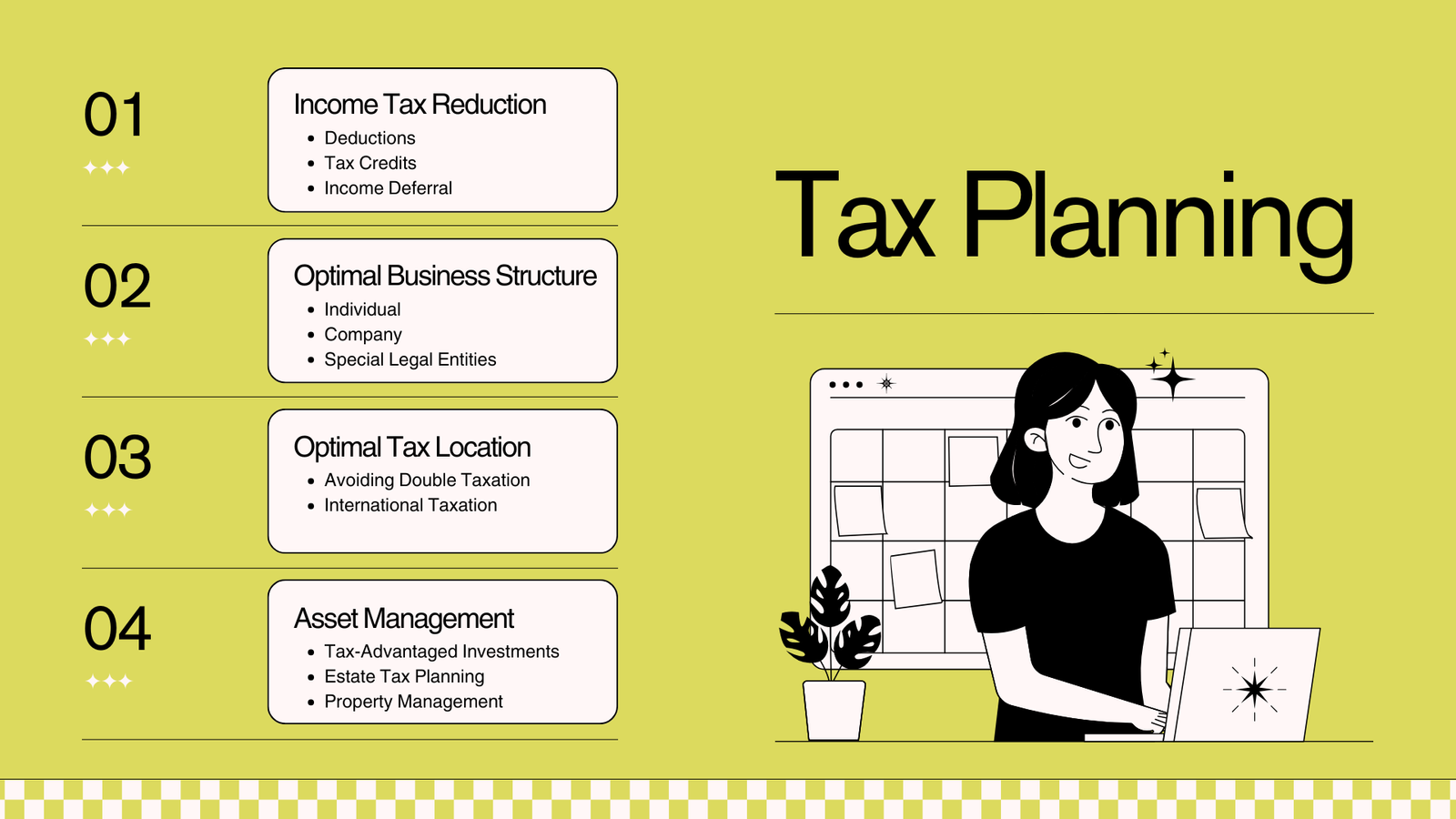

6. Tax Planning for Couples

Budgeting apps can also help you prepare for tax season by tracking deductible expenses, charitable donations, and other tax-related items.

Frequently Asked Questions (FAQs)

Are budgeting apps safe to use?

Yes, most budgeting apps use encryption and other security measures to protect your financial data. However, it’s important to choose a reputable app and use strong passwords.

Can unmarried couples use these apps?

Absolutely! Many budgeting apps, like Zeta, are designed with unmarried couples in mind.

What if one partner is reluctant to use a budgeting app?

Start by having an open conversation about the benefits of budgeting together. You can also suggest trying a free app or starting with a simple system.

Are there free budgeting apps for couples?

Yes, apps like Mint and Honeydue offer free versions with basic features.

How do I switch from one budgeting app to another?

Most apps allow you to export your data, making it easy to switch to a new platform. Be sure to review the new app’s features and compatibility before making the switch.

Conclusion

In 2025, budgeting apps have become an indispensable tool for couples looking to manage their finances effectively. By choosing the right app and using it consistently, you can reduce financial stress, achieve your goals, and build a stronger relationship.

Take the first step today by exploring the apps mentioned in this guide and discussing your financial goals with your partner. Remember, budgeting is a journey—not a destination. With the right tools and mindset, you can create a brighter financial future together.

External Links for Further Reading:

The Balance’s Review of Honeydue